Their estimates for BTC’s price are swelling through the roof, and while they await their ETF applications to be approved, they’ve been building up control over Bitcoin’s miners – in stealth mode!

It appears that banks are not just interested in owning some Bitcoin. Could they also be entertaining the possibility of controlling it?

Let’s dive into a captivating story of power, influence, and ambition!

TLDR 📃

- Price estimates for BTC are sky-high as institutions expect $120k by next year and $1.48 million by 2030.

- Vanguard amasses large stakes in two of the largest BTC mining companies in the U.S.

- SEC acknowledges Blackrock’s ETF filing, response expected in August.

- Bitcoin’s hashrate hits an all-time high, making it harder to attempt a network takeover.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

How does BTC at almost $1.5 million sound? 💰

Institutions are almost becoming as bullish about Bitcoin as we are – and they aren’t hiding it!How did we figure this out? See their price estimates!

Standard Chartered raised its price target for BTC to $120,000 in the next 18 months. Four months ago, it had a $100,000 price target on BTC.

The analysts at the bank pumped up their BTC price target by 20% in response to the surging momentum for BTC ETF applications. We expect their BTC price estimates to jump even higher as excitement builds up.

If you think Standard Chartered’s estimate is bullish, wait until you see what the analysts at Ark Invest think.

Ark Invest’s estimate for BTC goes as high as $1.48 million by 2030! That would give BTC a market cap of $31 trillion.

Wall Street is betting on BTC reaching 6 figures 🏦

As far as Wall Street is concerned, Bitcoin isn’t just another currency or asset. It is a revolutionary force set to transform the financial sector. And you can see them placing bets that reveal their convictions.Vanguard spends half a billion dollars on BTC stocks

For one, Vanguard has been investing hundreds of millions into BTC while awaiting a response from the SEC. But Wall Street, being Wall Street, these guys aren’t buying up BTC from exchanges. They are taking a roundabout way to gain exposure to BTC by investing about $560 million in mining stocks.Now, Vanguard has a 10% stake at Riot and Marathon, two of the largest mining companies in the U.S. We are beginning to suspect that some of Vanguard’s analysts might even be Cryptonary members because we gave out alpha on these stocks; check it out here.

Blackrock’s move closer to a Bitcoin ETF

Interestingly, the SEC has acknowledged Blackrock’s ETF filing, indicating that no revisions are likely necessary and that the application is currently under review.The SEC’s decision on Blackrock’s application will likely be a watershed moment for Bitcoin. Depending on what the SEC decides, you can expect a large swing for Bitcoin in either direction.

The SEC’s expected to give a decision next month or indicate more time is needed for review. We’ll keep you informed on the latest updates here at Cryptonary!

Miners double down on Bitcoin; hashrate hits new ATH 👩💻

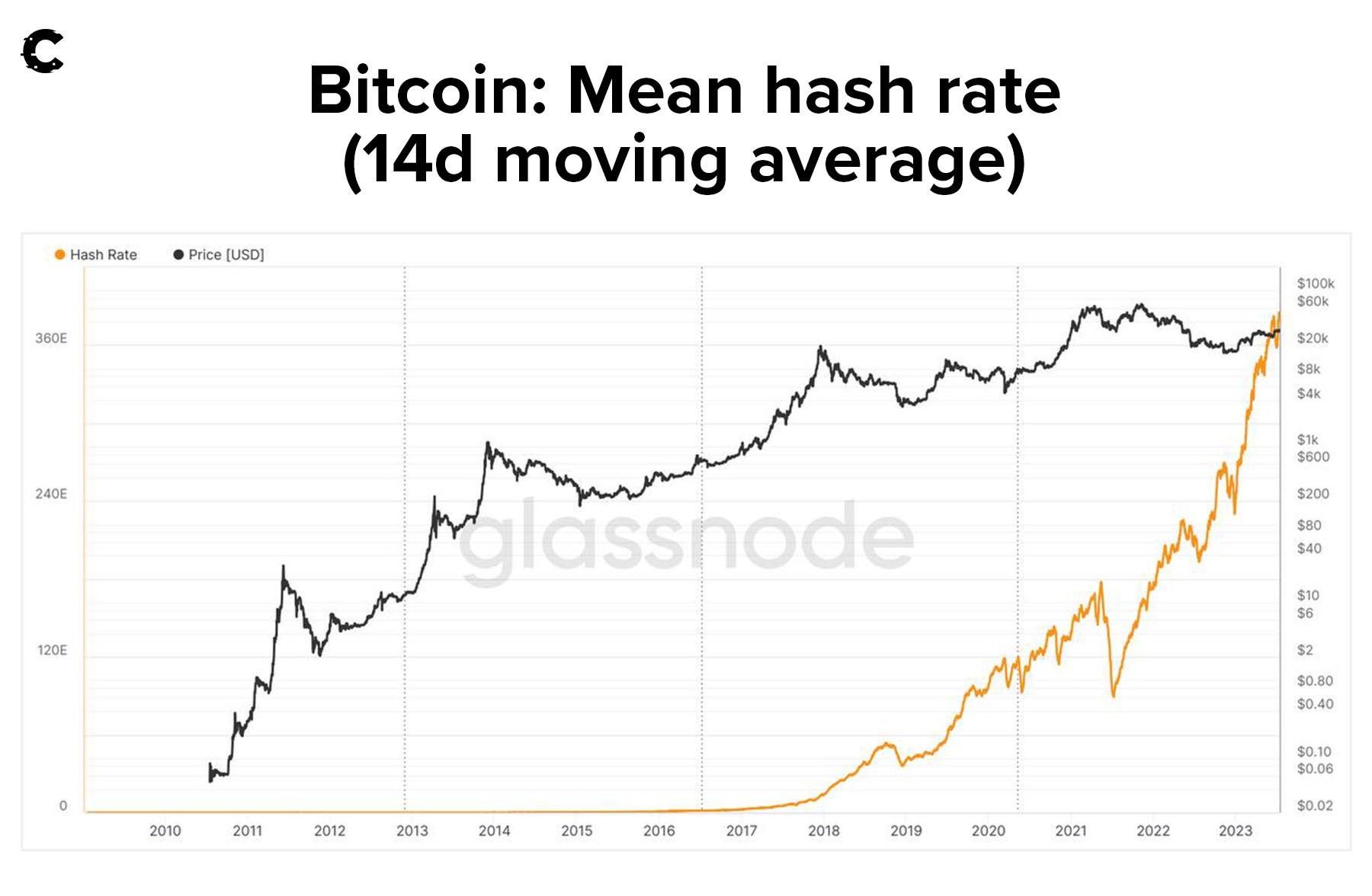

Wall Street’s growing interest in BTC mining from top dogs like Vanguard and Blackrock has made BTC mining more popular.The chart below illustrates Bitcoin’s hashrate.

Bitcoin’s network hashrate continues to explode, suggesting more miners are starting to mine Bitcoin or existing miners are growing their operations. Either way, Bitcoin mining is more attractive than ever!

This development is good news on two fronts.

At the surface level, the growing hashrate indicates a growing interest in BTC mining, which can signal bullish expectations for Bitcoin.

At the deeper level, the growing hashrate means it will become increasingly difficult for any single player to own a controlling share of Bitcoin’s hashrate. Whoever control’s Bitcoin hashrate can technically control the network; the higher the hashrate, the more economically prohibitive it becomes to attempt to own a controlling share of the network.

However, we still won’t place it past institutions to try this! After all, Vanguard has been loading up on mining stocks. Power over mining companies could potentially give investors like Vanguard control over Bitcoin’s hashrate.

If there’s ever a fork or a dispute, the hashrate determines the outcome of the dispute or which chain survives. We still have a side eye on the fact that some ETF applicants have disclosed that they may not vote for the most popular chain if a fork or dispute ever arises.

But we are confident that Bitcoineers can more than match Wall Street.

Price analysis 📊

To start things off, we will look at BTC's dominance - something juicy just happened.

Last week, we saw a large amount of capital flowing into the altcoins market. As a result, Bitcoin's dominance dropped and will likely continue to fall to our expected region between 48% - 49%. This will significantly affect altcoin performance, meaning you're primed to record more gains in the short term.

As far as BTC is concerned, its price is somewhat stable...

BTC almost tested $32,000 last week before sellers stepped in and blew the day. Not to worry, because we're still on for $32,000 and may even see a break of that level soon.

XRP winning their lawsuit had a more significant impact on the market from a psychological standpoint, and we're now trading in bullish territory.

Of course, to reach $35,000 or maybe even $40,000, we'll need to tackle the $32,000 resistance level first. Once that's flipped into support, the game is on!

Cryptonary’s take 🧠

As the love for Bitcoin picks up on Wall Street, the best action plan is to hodl because the Bitcoin rollercoaster is about to gain speed.Competition is already ramping up over control of BTC mining companies, which themselves control substantial amounts of BTC’s hashrate

Wall Street has already bet hundreds of millions of dollars on Bitcoin. And it can only mean one thing. If and when their ETFs are approved, the amount of capital they’ll likely bring into Bitcoin will be astronomical.

It will be one hell of a ride – and it is still Day 1 for Bitcoin!

As always, thanks for reading! 🙏

Cryptonary, out!

Take your next step towards crypto success

Login or upgrade to Cryptonary Pro

Pro

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

$1,548 $799

No risk. Only upside. If we don’t outperform the market during your subscription, we will give you 100% of your money back. No questions asked

What’s included?

24/7 Access to Cryptonary's Research team who have over 50 years of combined experience

All of our top token picks for 2025

Our latest memecoins pick with 50X potential

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily Market Updates that cover the real data that shape the market (Macro, Mechanics, On-chain)

Curated list of the most lucrative upcoming Airdrops (Free Money)

Success Guarantee, if we don’t outperform the market, you get 100% back, no questions asked

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the success guarantee work?

If our approach to the market doesn’t beat the overall crypto market during your subscription, we’ll give you a full refund of your membership fee. No questions asked.