Yet, it's not the throne that caught our attention - two mysterious kingmakers are making moves that could change the game entirely. And a dark horse lurks in the shadows, ready to sprint ahead.

Let’s explore how these two players could trigger an unprecedented growth cycle for Arbitrum.

Drumroll… Camelot and GMX.

TLDR 📃

- Camelot's strategic proposal to the Arbitrum DAO could rejuvenate growth.

- GMX's transition to V2 aims to rekindle interest in Arbitrum with lower fees and a broader asset range.

- Surprisingly, Umami Finance could reap significant benefits when the stars align.

- The stars might be aligning for Arbitrum to get another supersonic ride.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Setting the stage for Camelot’s gambit ♟

Arbitrum's rise was meteoric. Its Total Value Locked (TVL) soared from $980 million to $2 billion in mere months. However, the growth has now plateaued.

Camelot, the largest native decentralised exchange on Arbitrum, might yet save the ecosystem. And it all hinges on an audacious proposal to the Arbitrum DAO.

Camelot suggests a monthly influx of 2 million ARB tokens over six months, earmarked for liquidity incentives for Arbitrum-dedicated projects.

If approved, these tokens, coming out of Arbitrum Foundation and Arbitrum DAO's $3.9 billion treasury, would bolster liquidity providers on Camelot.

If the proposal passes, we can expect the following outcomes:

- An increase in Camelot's TVL, spurred by these new incentives.

- A surge of capital into Arbitrum, stimulated by enticing rewards.

- Enhanced competitiveness of Arbitrum and Camelot against rivals.

- Pressure on the ARB token price due to inflation and competing incentive proposals.

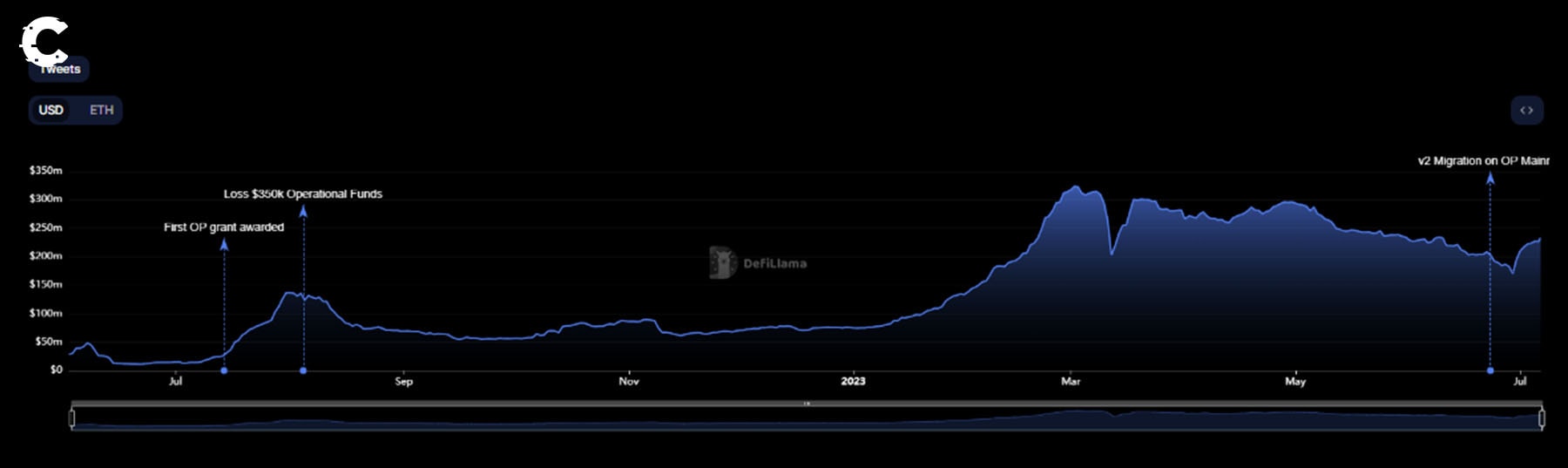

In our assessment, this proposal is reminiscent of Velodrome's initial OP grant. And same as what we saw on Velodrome (see chart below), the benefits could ripple across the Arbitrum ecosystem, bolstering Camelot's standing as a leading liquidity hub.

A nod of approval could reignite growth, sending a bullish signal for Camelot. However, the Arbitrum DAO's balancing act in prioritising ecosystem growth and managing ARB token price will be a spectacle.

GMX V2: an update that can reignite interest in Arbitrum 🎇

GMX is another pivotal player in Arbitrum's chessboard, and its upcoming transition to V2 could be a game-changer.

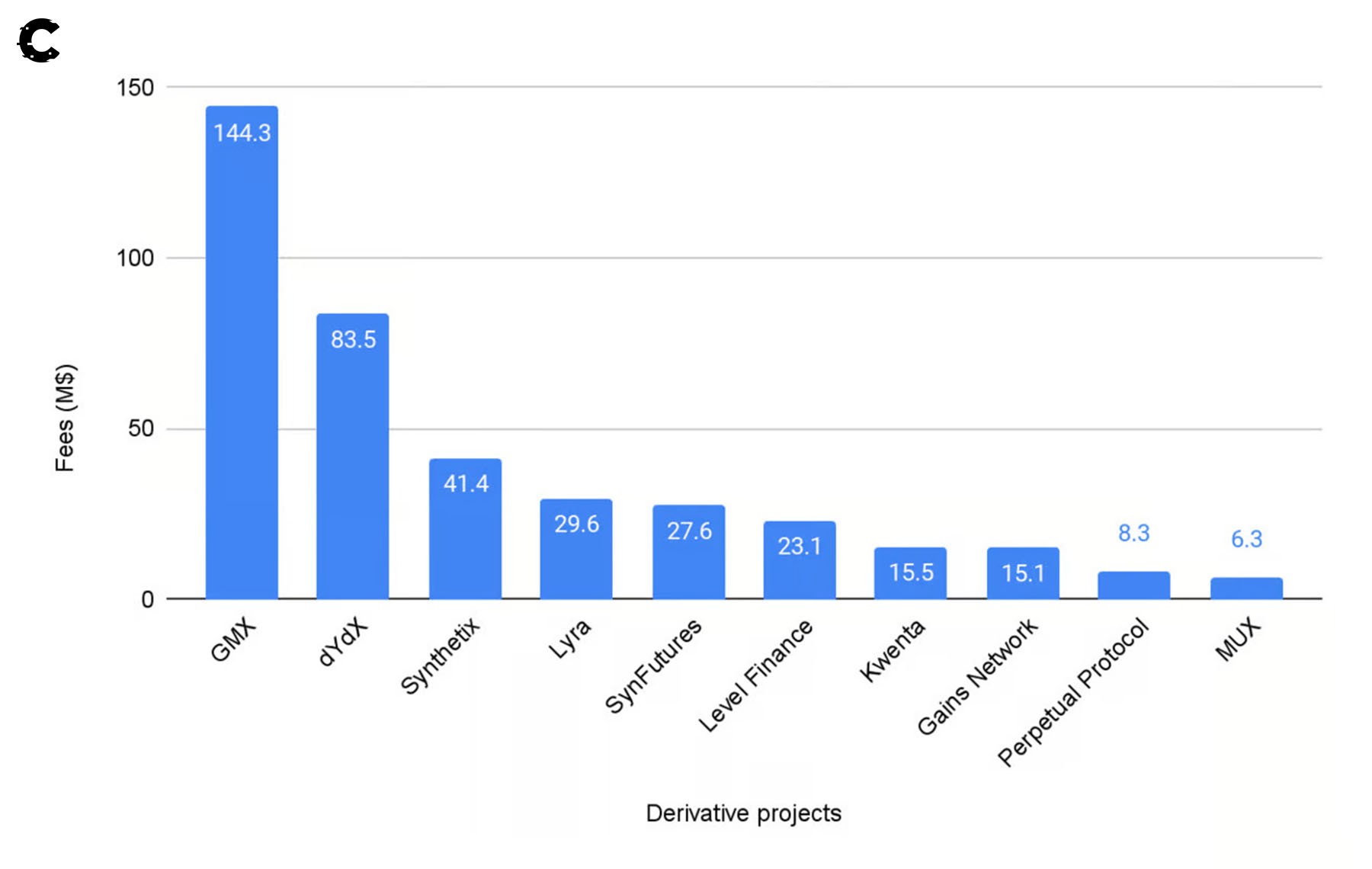

It commands respect as the top derivatives platform in revenue generation this year. However, competitors like DyDx and Synthetix aren't sitting idle. GMX's V2 evolution could be a solid countermove to stand clear of rivals.

How does GMX plan to achieve that?

Currently, GMX faces several challenges, but it is addressing them head-on. GMX's weaknesses, such as a limited asset portfolio, higher fees, and suboptimal capital efficiency, have become the stepping stone into its V2.

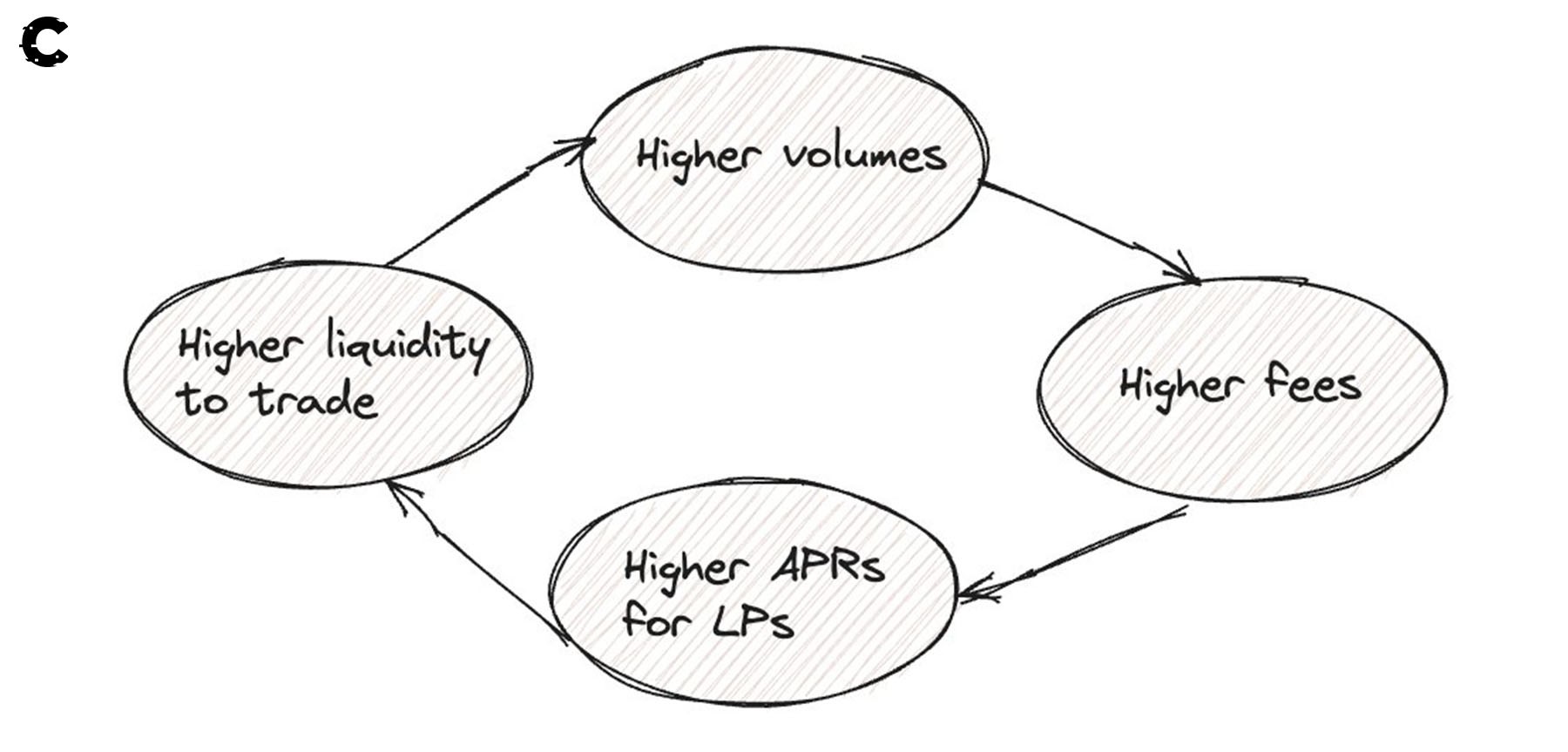

By curbing fees, enhancing liquidity provider security, and expanding its asset offering, GMX aims to create a virtuous cycle. More traders attracted by improved conditions bring more revenue, compensating for the lower fees.

V2 will also simplify protocol development and automated strategies. In addition, it is ushering in a new era of user convenience by allowing protocols to host front-ends on the GMX platform.

These strategic enhancements could serve as a launching pad for new protocols or expanded offerings from existing ones.

And we've already identified a potential frontrunner set to seize this golden opportunity.

Coming up next…

Umami Finance: A dark horse primed for the win 🐐

Have you heard of Umami Finance?

This promising DeFi protocol is stirring interest with its freshly unveiled public beta yield strategy.

Imagine depositing USDC and watching revenue accumulate, immune to the fickle swings of market prices. That's precisely what users can expect with Umami's automated strategy on GMX.

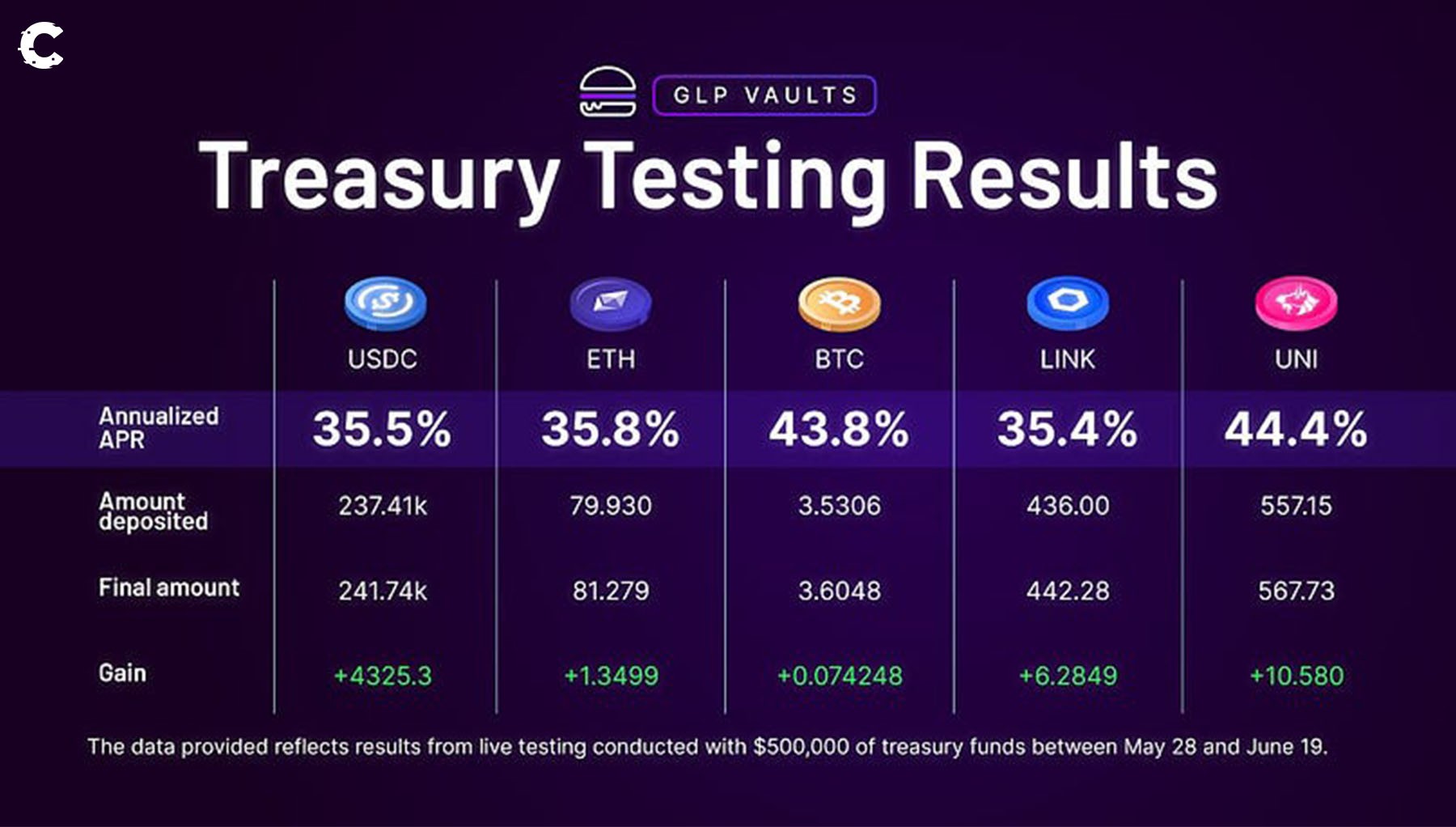

This is a significant move. As liquidity providers on GMX can attest, the risks of market volatility with assets like BTC, ETH, LINK, and UNI can overshadow revenue gains. But Umami is flipping the script.

Despite its beta tag and $1M TVL, the protocol has been churning out impressive results, delivering a handsome APR of 35% in its treasury tests.

And the pie isn't just for yield earners. $UMAMI token holders are set to share 50% of the revenue from Umami's vaults and activities.

Umami is also a valued member of the Camelot Round Table, a fellowship of protocols dedicated to driving growth in the Arbitrum ecosystem.

Should Camelot's proposed ARB incentive scheme get the nod, Umami is poised to reap a generous portion of its liquidity pools.

In addition, another factor favouring Umami is its veteran status with GMX.

With over a year of strategy development, the Umami team knows the GMX battlefield like the back of their hand and is ready to take on GMX V2 from the get-go.

For these reasons, Umami Finance stands out as a rising star in DeFi, with a promising beta product and solid alliances.

Is it a good time to buy $UMAMI? 📊

Nonetheless, under a few months of ranging under resistance ($17.50), UMAMI has broken out and is ready to rip.

There's been a shift in weekly market structures from bearish to bullish, which makes us believe UMAMI will now aim for a steady ride to its next resistance level at $25.85. From its current price, that's ~30% away.

Of course, there's also an invalidation criterion. The deal breaker for us would be a weekly loss of $17.50 - this will end any more upside and hint at more downside.

Cryptonary’s take 🧠

Camelot's first-ever token grant proposal to Arbitrum DAO could redefine the landscape, with Arbitrum's Total Value Locked (TVL) set to benefit. Yet, the ARB token could feel a pinch, making this a noteworthy development.

Additionally, GMX V2's promise of lower fees and a more comprehensive asset range may reignite Arbitrum's spark.

However, Umami Finance is the one to watch. With a successful product launch and strong ties with Camelot and GMX, Umami is gaining momentum. As the token eyes a $25.85 mark, we maintain our bullish stance, provided it hovers above $17.50.

In DeFi's shifting sands, Arbitrum, Camelot, GMX, and Umami may become the perfect storm, marking a thrilling new chapter in this ever-evolving narrative.

As always, thanks for reading.🙏

Cryptonary, out!

Get winning crypto tips in 5 minutes a day

Login or upgrade to Cryptonary Pro

Pro

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

$799

For your security, all orders are processed on a secured server.

What’s included?

24/7 Access to Cryptonary's Research team who have over 50 years of combined experience

All of our top token picks for 2025

Our latest memecoins pick with 50X potential

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily Market Updates that cover the real data that shape the market (Macro, Mechanics, On-chain)

Curated list of the most lucrative upcoming Airdrops (Free Money)

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.