Last week, the SEC sued crypto trader Avraham Eisenberg for an attack on Mango Markets. The notorious investor’s “highly profitable trading strategy” drained the DeFi exchange platform of over $116 million. The more fascinating aspect of the case was the asset at the heart of it – in its lawsuit, the regulator labelled Mango’s governance token, $MNGO, a security.

For those in the know, this is a serious development. Without an exemption, selling securities without first registering them with the SEC is illegal. Mango Markets and numerous other DeFi products have failed to do this.

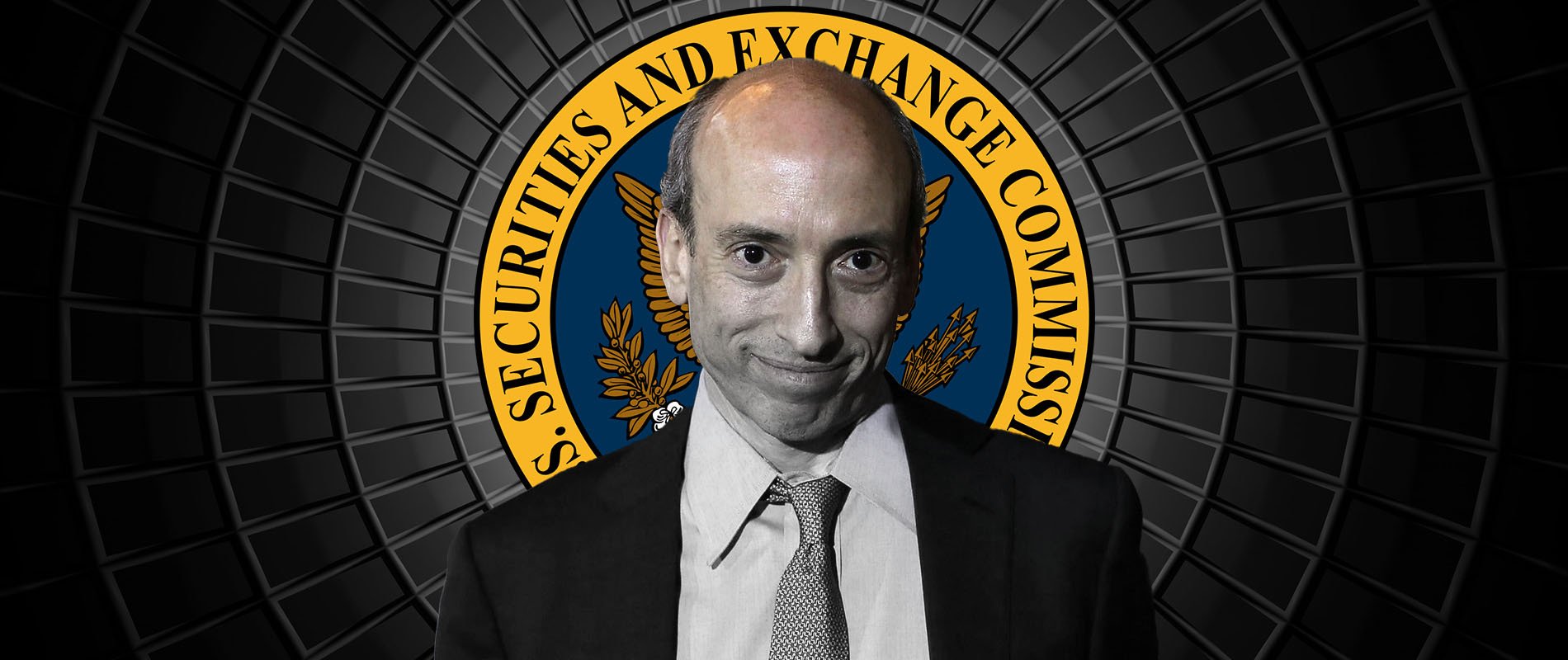

What does this mean? Is this the beginning of a regulatory crackdown, and is your favourite project at risk?

Let's find out…

TLDR

- The SEC claims $MNGO is a security.

- It's currently illegal for a security to trade without being registered with the SEC.

- If $MNGO is found to be a security, the SEC may use this as leverage to crack down on similar projects. This could mean the end of many of your favourite DeFi investments.

- To spare themselves from the SEC’s wrath, DeFi projects in the US need to prioritise decentralisation.

- There are steps you can take to protect your portfolio by diversifying across assets that are likely not to be deemed securities. This would require a review under the Howey Test. We’re happy to help.

Sir, we have a security breach

The term "security" refers to a range of financial assets such as stocks, bonds, notes, and investment contracts. In the US, all securities must be registered with the SEC in order to be sold or otherwise offered to investors.These regulations are designed to protect the public from investments that are considered to carry above-average risk.

Wait, so we’re allowed to gamble away our life savings in a Las Vegas casino, but we can't invest in a start-up? Sure, those intentions seem pure.

To determine whether or not a digital asset is a security, the SEC uses a tool called the Howey Test. This test lays out four criteria: investment of money, common enterprise, expectation of profit, and derived effort from others.

If an asset falls in the centre of the four-corner diagram, it’s deemed a security. Let’s see how $MNGO stacks up…

What’s the future for Mango Markets?

It's unclear what the outcome of the Mango Markets case will be. However, it serves as a warning to DeFi projects based in the US and those that have sold tokens to US investors.If $MNGO is deemed a security, the SEC will surely use this as leverage to investigate other DeFi projects.

The SEC has already conducted similar investigations into firms such as Ripple, Gemini, and Telegram due to their centralisation. The performance of their tokens will always be dependent on the companies upholding their commitments.

Cryptonary’s Take

All that said, we believe it’s unlikely that the SEC will initiate an industry-wide crackdown on DeFi projects. They’ve barely been able to fight their way out of a paper bag dealing with just one (Ripple).However, it is likely that DeFi projects that remain highly centralised, or have sold governance tokens to US investors, will face scrutiny this year.

The truth is a lot of these projects will probably be considered securities. This is very likely to affect prices, so we strongly recommend reviewing one's portfolio to see if it holds any potential regulatory targets.

We predict that, in the long term, crypto will be divided into two classes, similar to how the internet was divided into the "clear web" and the "dark web."

The clear half of DeFi will adhere to regulations imposed by authorities, even if this means some projects have to sacrifice their initial goals. This might mean introducing “know your customer” processes, or giving up the ambition of sharing revenue with token holders, among other compromises/sacrifices.

The dark projects will be driven further towards anonymity while trying to ensure they’re decentralised enough that regulators cannot shut them down.

We’re still investing and holding various DeFi tokens while acknowledging the risk of a sudden clampdown by the SEC. If that were to happen, we believe the effect would be pretty bad but temporary. The United States is only one jurisdiction in the world.

Our theory is that if they were to clamp down on DeFi, other countries would embrace it and attract the capital themselves. We believe US regulators are smarter than that, we could be wrong, though.

Action Points

1: Read the SEC's claims against Mango Markets. Then, use the Howey Test criteria to help determine whether the token you’re investing in is a security or not.2: As the SEC is the regulator of American financial markets, find out whether the project’s team is located in the country or whether they sold tokens to US investors during their launch.

3: Ask project stakeholders about their views on regulation and find out how the project intends to avoid getting into trouble with the SEC.

Note: It’s a big red flag if the project doesn’t have a realistic plan for compliance, and if its token meets most or all of the Howey test criteria.

Get winning crypto tips in 5 minutes a day

Login or upgrade to Cryptonary Pro

Pro

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

$799

For your security, all orders are processed on a secured server.

What’s included?

24/7 Access to Cryptonary's Research team who have over 50 years of combined experience

All of our top token picks for 2025

Our latest memecoins pick with 50X potential

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily Market Updates that cover the real data that shape the market (Macro, Mechanics, On-chain)

Curated list of the most lucrative upcoming Airdrops (Free Money)

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.