But with so many staking platforms available, finding the right staking provider is harder than picking the prize pig at a country fair.

We selected five liquid staking platforms and evaluated their offerings, including their APY rates, decentralisation approach, security measures, and user experience. We subjected Coinbase, Frax, Lido, Rocket Pool, and Stakewise to our devilishly detailed acid-test.

By the end of this article, you'll know each platform’s strengths and weaknesses. You'll be empowered to make an informed choice about where to stake ETH.

Better yet, you’ll be able to use our framework for evaluating staking platforms and apply it to platforms you encounter in the future.

TLDR 📃

- Frax Finance offers the highest staking rewards.

- Rocket Pool is the most decentralised staking platform.

- Lido offers a $2M bug bounty and it's well-integrated DeFi, with many apps accepting its token as collateral.

- Coinbase offers the simplest user experience for crypto newcomers.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

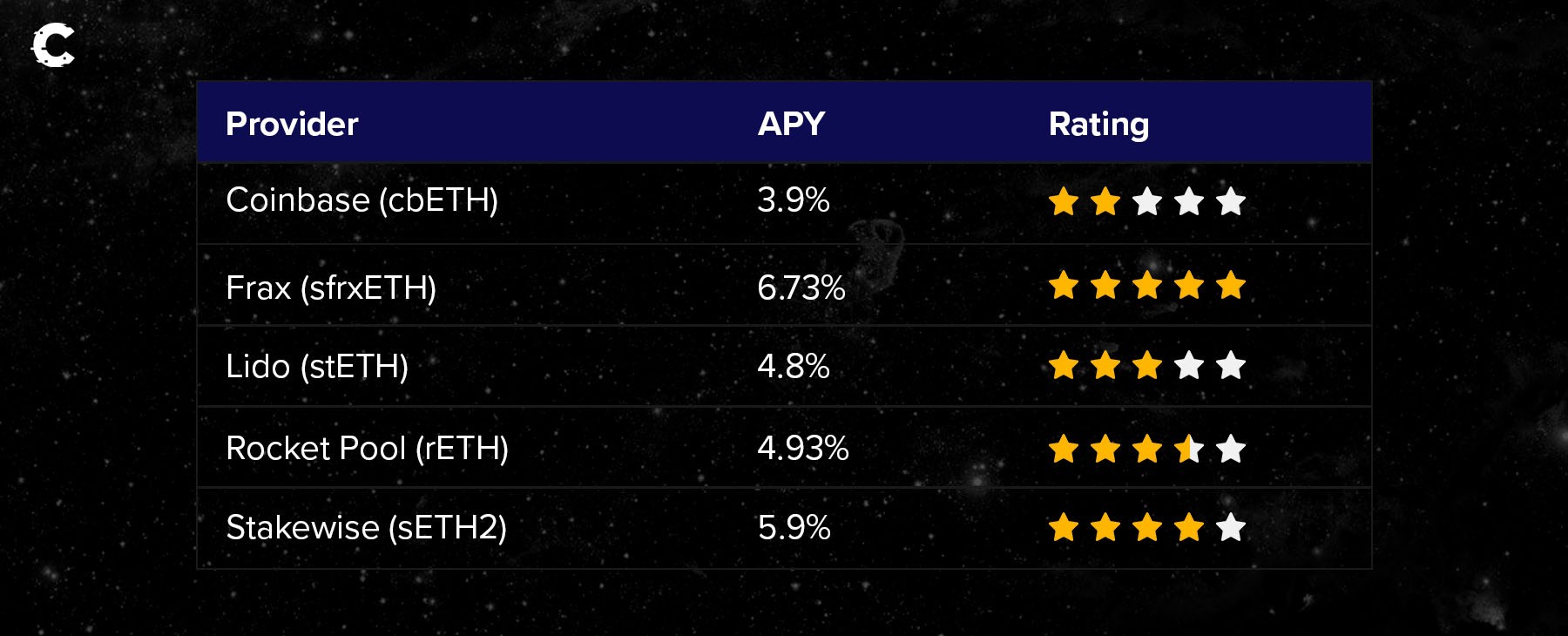

Where can you earn the best yield? 💵

When it comes to staking ETH, the rewards you can earn are probably the primary consideration. But platform fees can significantly impact overall returns, making it important to evaluate them as well.Here’s how liquid staking providers stack up on yields after fees are deducted:

Frax Finance is best in the test when it comes to the net yield on staked ETH. Rocket Pool and Stakewise are also reasonable choices.

You might choose to stake ETH at Coinbase, but it would have to be for some other reason. Its 3.9% APY puts it at the bottom of our list.

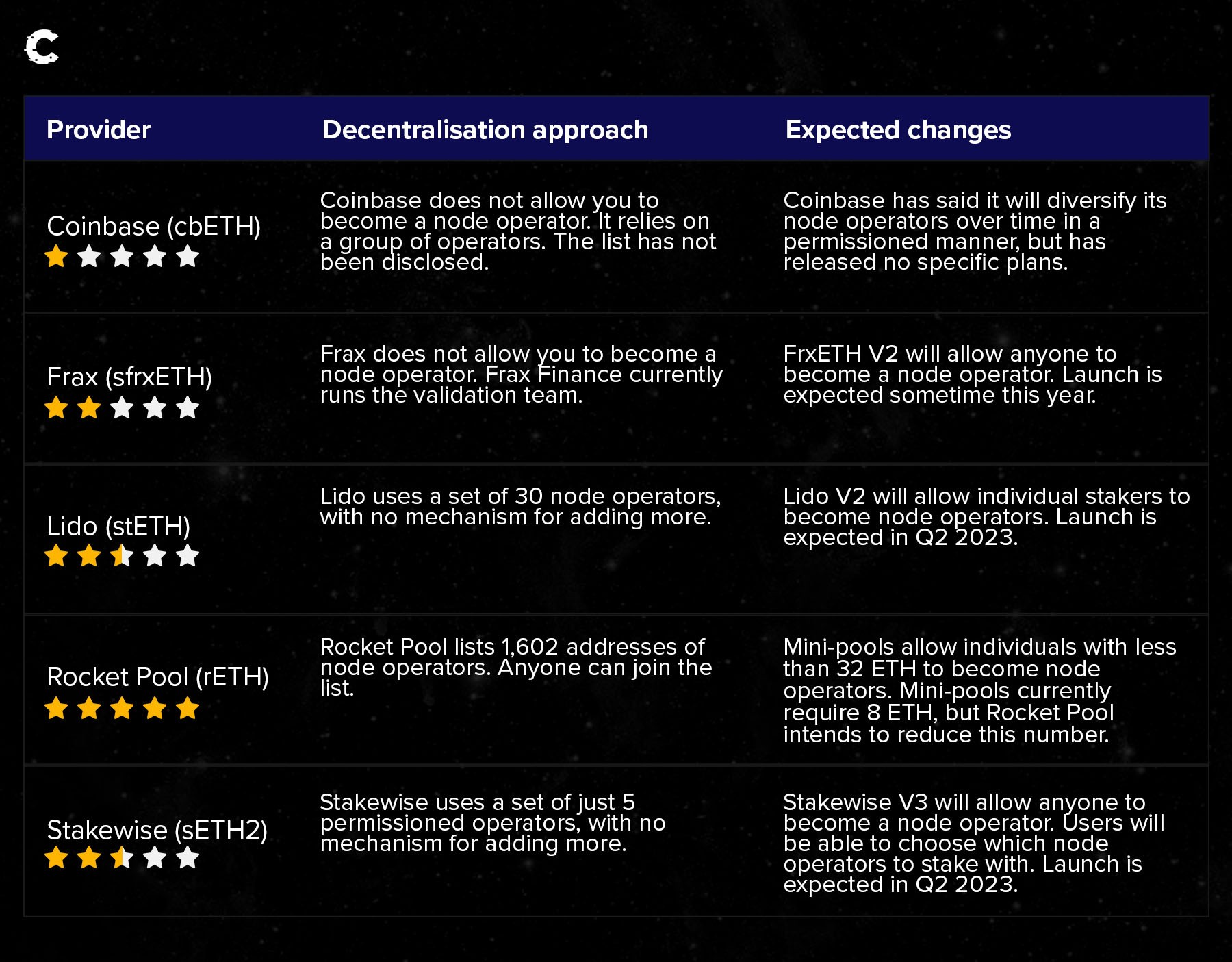

Decentralisation 🕸️

Decentralisation is a critical metric for anyone who cares about security. A staking platform’s governance and validating nodes should be as decentralised as possible to withstand attacks and other risks.

Rocket Pool is the clear decentralisation leader. Several of the other platforms are currently working to decentralise their validating teams in the future. Once they launch their upgrades, we’ll take another look at the rankings.

Lido and Stakewise are on the verge of requiring fresh evaluations already. We expect to see upgrades of both platforms during the second quarter of this year.

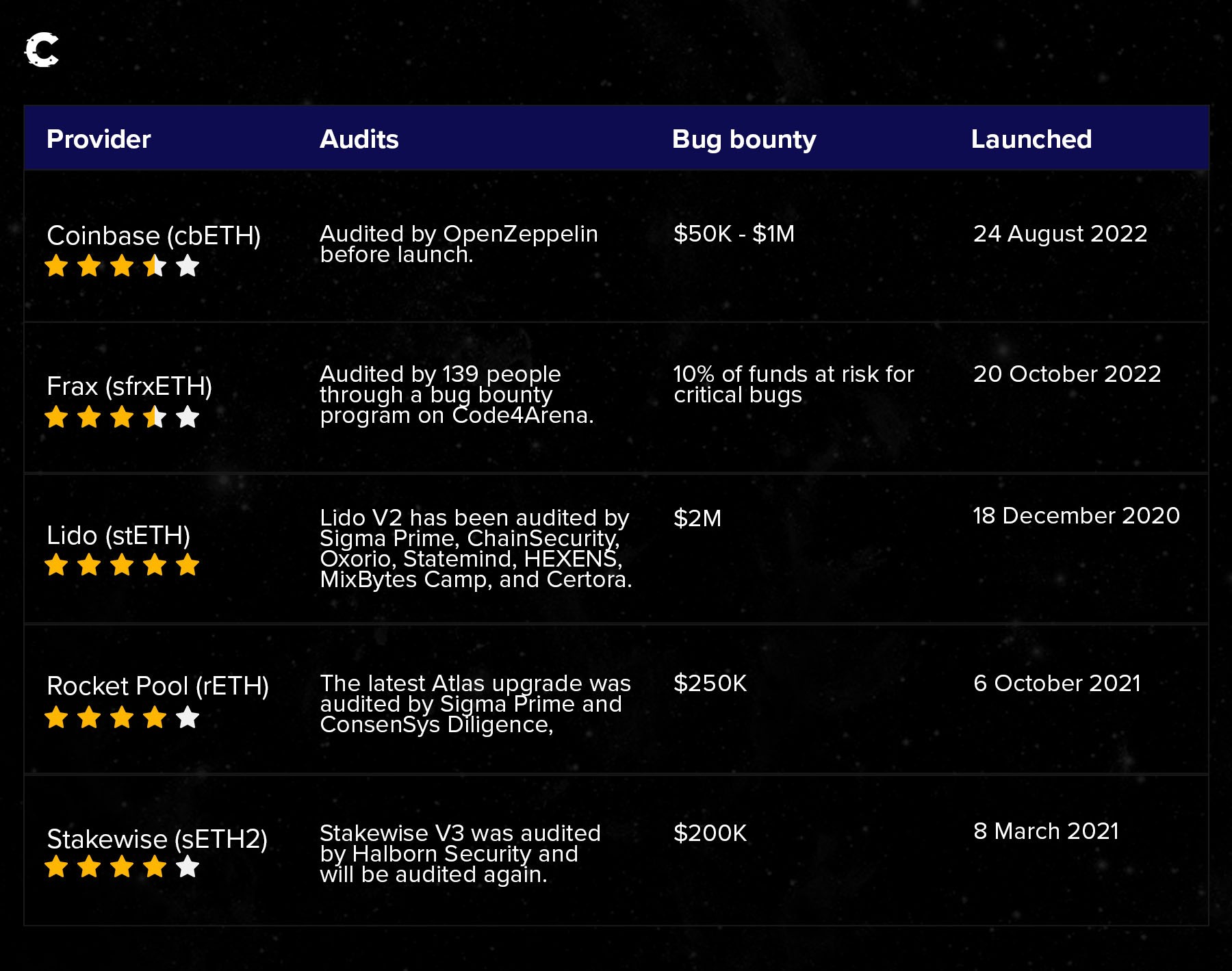

Security 🔒

Security should be at the forefront of your decision-making process when staking ETH. To gauge a project's security, consider its track record and the number of audits it has commissioned.

All staking providers prioritise platform security. They implement measures such as bug bounties and audits to keep users and their assets safe.

Lido stands out on our list. Lido V2, which is not yet live, has already undergone seven audits. In addition, Lido has offered a $2 million bug bounty, making it the clear winner in terms of security among staking providers.

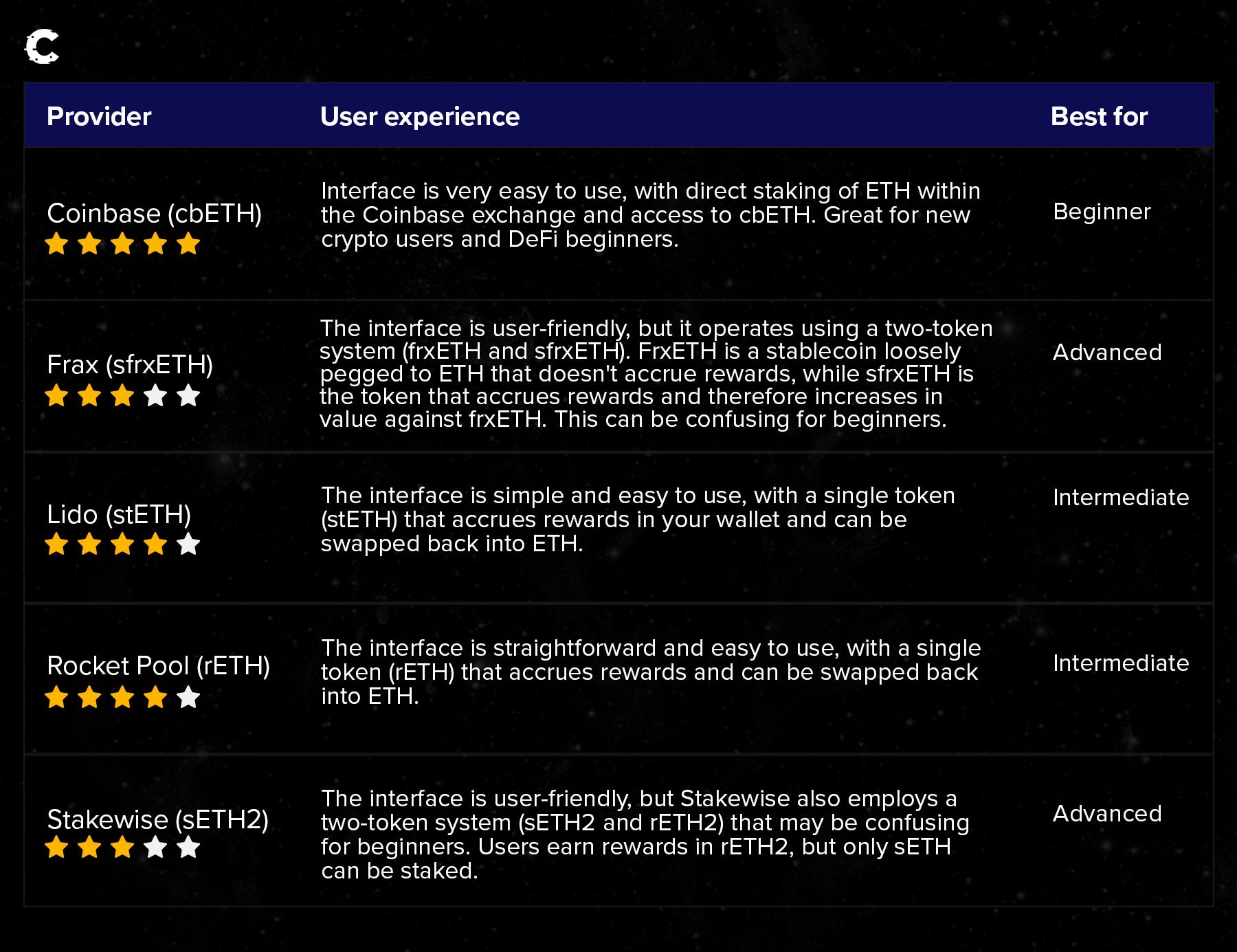

User experience 🧑💼

User experience is subjective, but it's important to ensure that staking platforms are user-friendly, especially for users who are new to crypto.

Coinbase's cbETH is the best choice for beginners. The other platforms are better for experienced DeFi users. Frax and Stakewise require a bit more effort because they both have two tokens instead of just one, which adds to complexity.

Interoperability 👯♂️

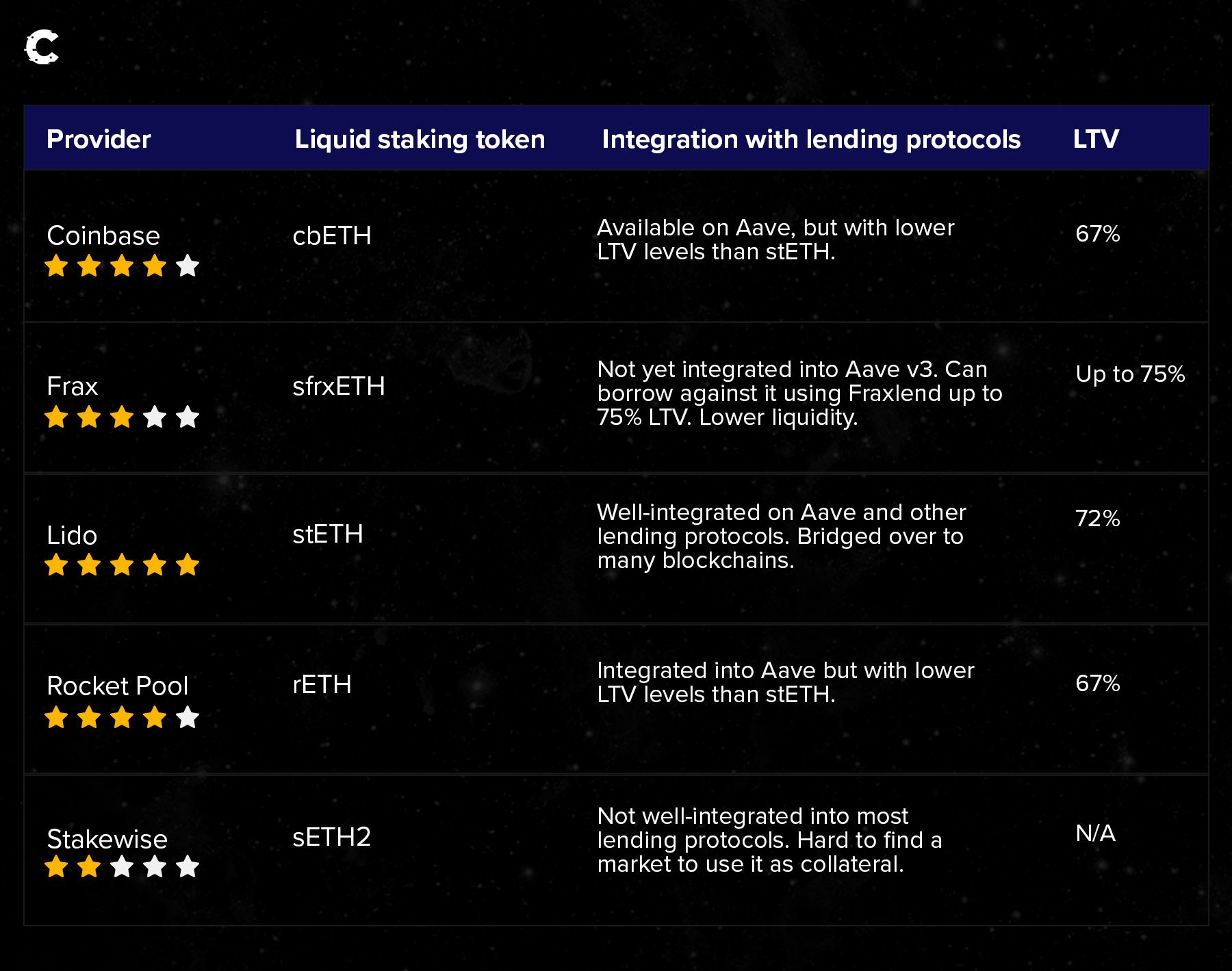

Interoperability is crucial to ensure that the liquid token you receive for staking your ETH is available for use within the DeFi world.If you're not planning to use your staked ETH as collateral for lending or other DeFi applications, then the level of integration may not matter much to you. But if you're a frequent DeFi user, having the ability to use your staked ETH across multiple protocols is definitely an advantage.

Lido stands out as the leader because of its integration with numerous DeFi protocols, followed by Coinbase and Rocket Pool. Frax has a strong advantage in offering lending and borrowing through its own protocol, Fraxlend. But it has yet to integrate with major protocols such as Aave.

Cryptonary’s take 🧠

Rocket Pool strikes a good balance between earning rewards, maintaining security, and supporting decentralisation. It is our preferred platform for staking ETH on this list.Everyone has different priorities, however, and may prioritise factors differently. Ultimately, it's important to consider your own preferences and investing needs. Use this article and its evaluation framework as a starting point as you decide which staking platform to use.

Frax Finance is a rising star in the staking world, and it earns the runner-up position in our rankings. It offers very competitive staking rewards, but it has a lot of work to do in terms of decentralisation and interoperability. If its V2 upgrade addresses these issues, Frax could well topple Rocket Pool from its position on the top of our list within six months.

Action points 🎯

- For a detailed explanation of staking on Rocket Pool, visit the Rocket Pool website.

- Want to stake Lido? You’ll find comprehensive instructions on our website.

- Last month we deposited ETH into a prerelease liquid staking protocol to qualify for a potential airdrop. Want to know which protocol? Check out our March Skin In The Game report.

100% Success Money Back Guarantee

If our approach doesn’t outperform the overall crypto market during your subscription, we’ll give you a full refund of your membership. No questions asked. For quarterly and monthly subscribers this is applicable once your subscription runs for 6 consecutive months.

Take your next step towards crypto success

$799/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

What’s included in Pro:

Success Guarantee, if we don’t outperform the market, you get 100% back, no questions asked

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

Our latest memecoins pick with 50X potential

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the success guarantee work?

If our approach to the market doesn’t beat the overall crypto market during your subscription, we’ll give you a full refund of your membership fee. No questions asked. For quarterly and monthly subscribers this is applicable once your subscription runs for 6 consecutive months.