With 2.5% of all ETH standing in line this week alone ready to be staked, we're seeing the future look even more bullish. But let's not forget: where there are gains, there are pains. This staking frenzy also brings about issues with MEV and reduces our staking yields. But hey, every problem's a hidden opportunity, right?

Let's dive in and break down the latest in the Ethereum universe in the simplest way possible!

TLDR 📃

- 3M ETH are in the queue ready to be staked! Bullish long-term, but this will reduce profits for each validator.

- Lido, controlling over 30% of staked ETH, could pose centralisation risks to Ethereum.

- MEV (Miner Extractable Value) dominates Ethereum activity, creating challenges for user experience. Intents, a new transaction type, could be a partial solution to MEV issues.

- ETH's price action is boring, but $1,400 is in sight, especially given the recent Binance lawsuit.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make is your full responsibility.

3M ETH in the queue ready for staking! 👊🏼

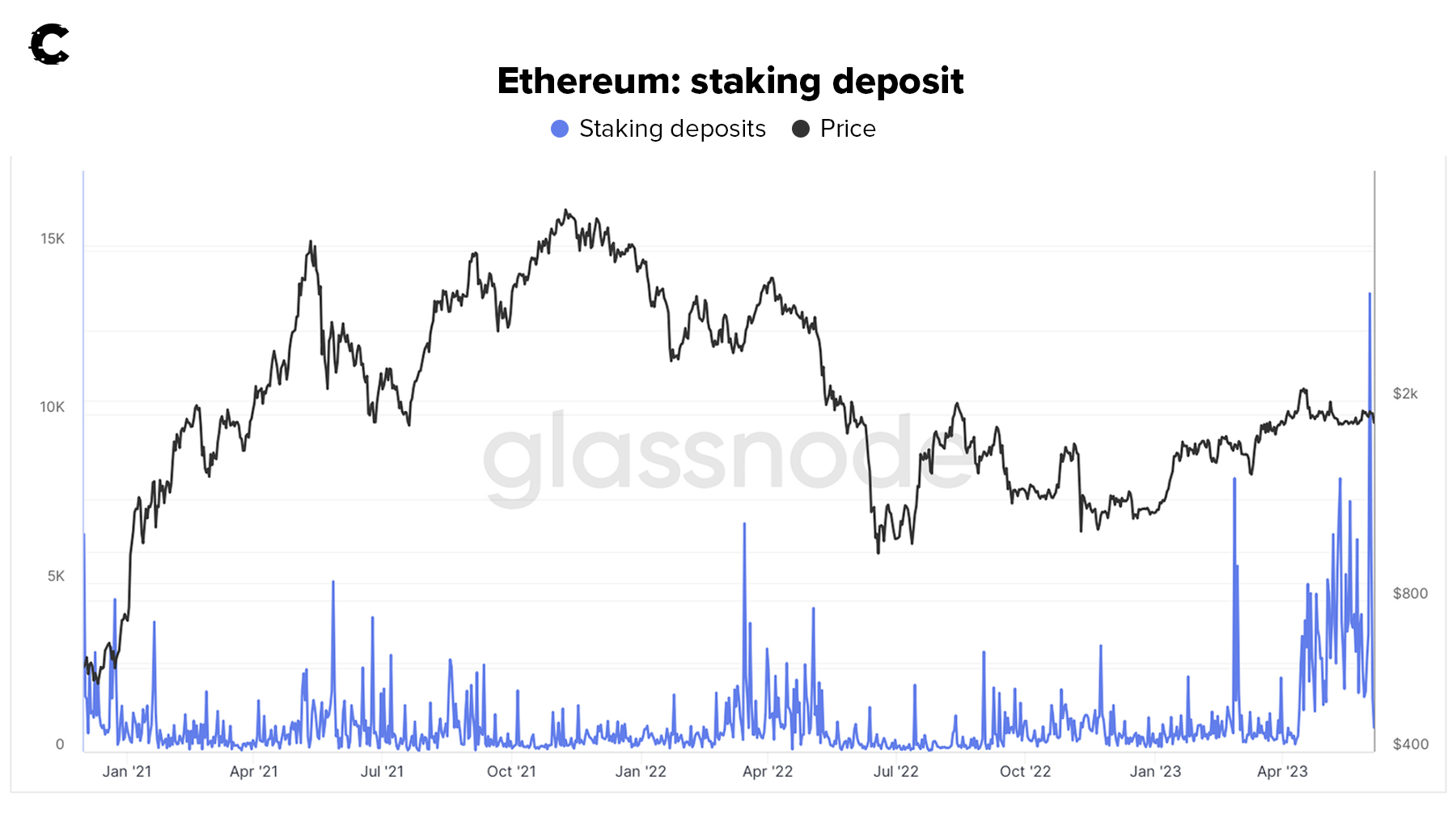

Wow, we're breaking records this week with 3 million ETH plunging into the staking queue! That's a whopping $5.5 billion, extending the queue time to a whole 45 days for new validators. Yes, you need to wait in line to become a validator!

Here's a perspective check for you. Since staking deposits began 1.5 years ago, we've seen a total of 22.5M ETH staked. This week's influx? A staggering 13% increase in under 1% of that time.

To add to the wow-factor, this fresh ETH accounts for about 2.5% of the entire ETH supply. It's an absolutely jaw-dropping quantity.

But there's a twist. More ETH in the staking queue means lower yield for all validators. The more validators there are, the less each earns. Despite this, staking's popularity is skyrocketing, likely spurred by potential extra profits from MEV. More validators mean more chances of adding a block and pocketing MEV income on top of the basic reward.

What’s MEV? Short for Miner Extractable Value, MEV is like the cherry on top for blockchain miners. It's the extra profit validators can squeeze out by smartly deciding which transactions to include in a block and in what order.

Lido’s getting greedy 🍽️

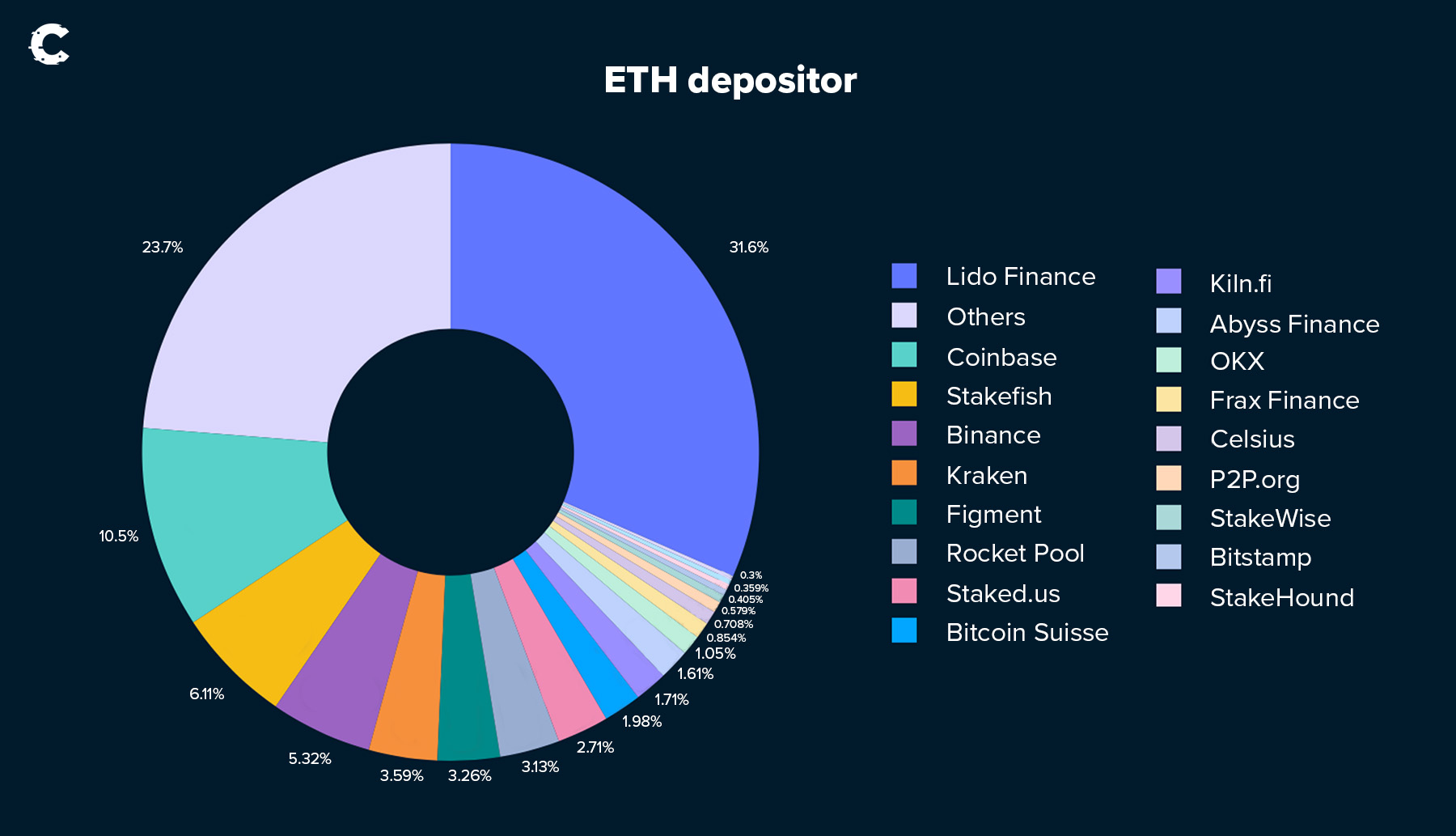

Let's talk about the ETH staking market and how Lido is really shaking things up. They've got a huge stake in the game - over 30% of all staked ETH and more than 80% via LSD (Liquid Staking Derivative) services.

A bit worrying, right? With Lido controlling over a third of staked ETH, it's a real concern for Ethereum. Let us tell you why.

Imagine Lido hits a snag or decides to stop verifying new blocks. This could lead to big delays. If a Lido node is chosen to add a block and it refuses, it will slow down consensus significantly and it could happen a third of the time. Even blocks added by the rest of the nodes could be slowed down because you need a certain number of nodes to verify each block.

Now, think about this. Lido could also start to censor transactions, choosing what to include or leave out. This could cause serious delays for those "censored" transactions. The scary part? They might be forced to do this under government pressure. So, their gigantic share of staked ETH is really risky.

The surprising part? Lido seems to be cool with it. They're not saying sorry or slowing down. In fact, if they could, they'd go for 51% of the staked ETH. Not exactly comforting, is it?

Most activity is actually just MEV 💰

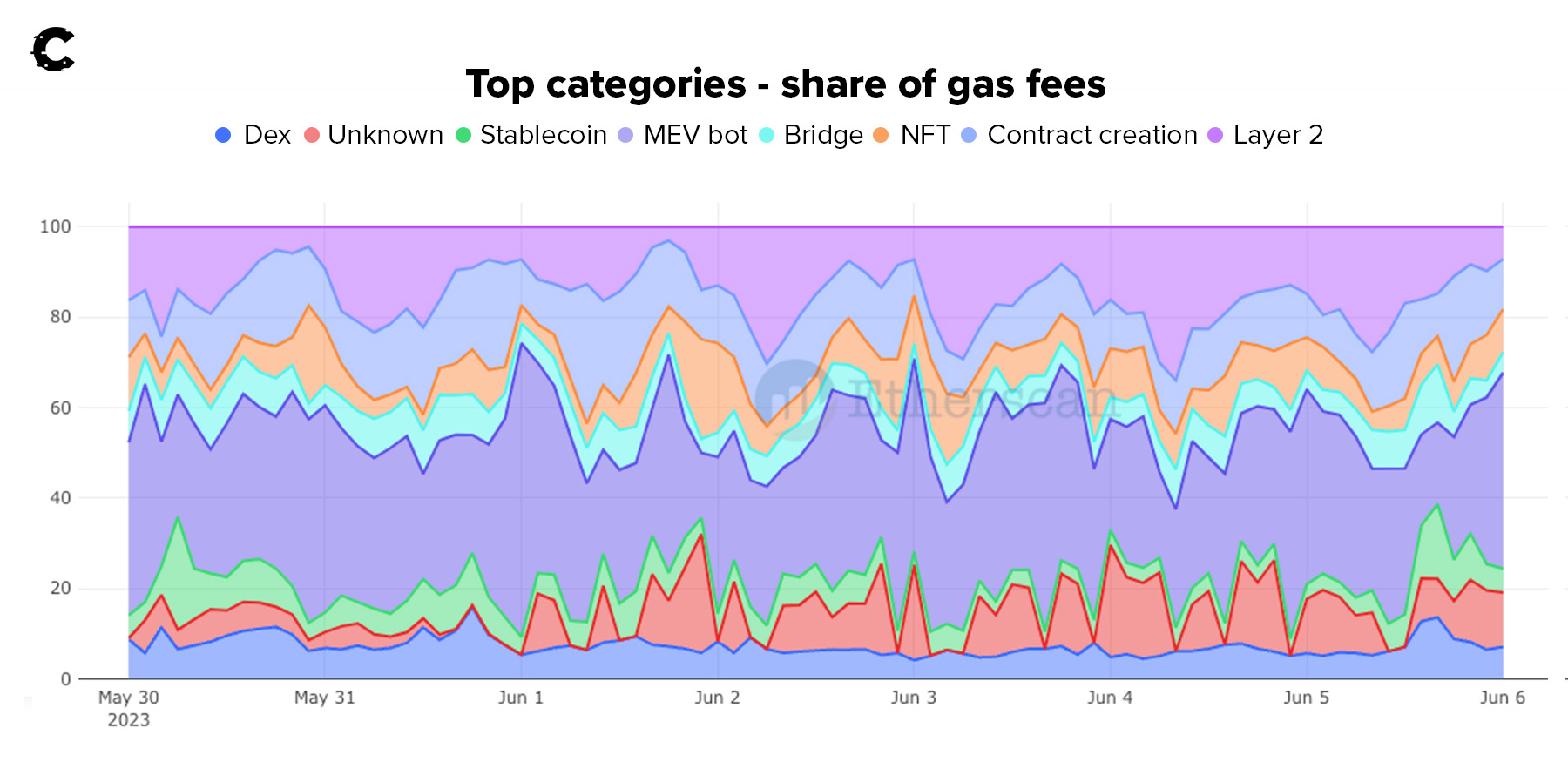

Validators are cashing in big time with MEV (Miner Extractable Value), and it's clear from the fact that MEV transactions now make up almost half of all Ethereum gas fees. Wondering what this means?

Well, MEV transactions are basically a way of profiting from upcoming transactions. Validators buy an asset before a major transaction pushes up its price. And to make sure their transactions are processed first, they often pay more in gas fees.

Here's the fun part - it's like a loop. Validators are spending a ton of gas on MEV transactions, and most of this gas ends up back with other validators. With half the gas spent on MEV, around 50% of a validator's MEV profits are essentially coming from their own pockets! It's a fair question to ask - without all this gas spending, would MEV be so lucrative?

An MEV solution?

Everyone's talking about Intents in Ethereum. They're a new kind of transaction that could help tackle some issues with MEV (Miner Extractable Value).Intents let you declare what you want from a transaction, like buying a certain amount of a cryptocurrency. Then, someone else (a group called "solvers" or "builders") handles the complicated parts, like executing the transaction for you. This can help make things run more smoothly and potentially even save you some money.

You can see this in action on a platform called CowSwap, where users announce what they want to trade and solvers compete to make the trade happen at the best price.

But just like our coffee shop example, it's not perfect. Communication can be tricky - it's like trying to shout your order in a noisy room. And while there are trusted groups to handle your order, if they become too powerful, it could lead to issues.

Still, when done right, Intents can be really beneficial. For instance, on CowSwap, it can help protect your trades from price changes that can happen during large transactions. So, even if you have to pay a tiny bit more in fees, it might be worth it for the peace of mind.

Price analysis 📈

Let's face it - ETH's price moves have been a real snooze-fest lately, and it's kinda tricky to figure out. When things get muddled, it's best to set clear lines to guide your decisions.

Right now, it looks like ETH is more likely to head down to $1,400. But hey, if it manages to flip $2,000 from being a roadblock to a springboard, we'll have to switch gears and get bullish.

Just keep in mind, with the recent drama around the Binance lawsuit, a dip seems even more probable now.

Cryptonary’s take 🧠

There's a lot going on in the Ethereum world. With more and more ETH getting staked and locked, things are looking bullish. Our bet? Around 30% of the ETH supply will end up staked. One hiccup though - Lido's huge market share might lead to centralization issues. But, as the saying goes, one man's loss is another man's gain - hello LDO profits?Meanwhile, much of Ethereum's activity is due to MEV, which isn't great news for user experience. Developers are brainstorming solutions like Intents, but it's still a work in progress. The challenge? Figuring out who executes these intent-based transactions and how they get assigned the job.

As for ETH's price, it's been a bit of a yawn fest and things are getting more complicated (thanks for nothing, Binance!). But there's a silver lining: the SEC lawsuit added some clarity for Ethereum by leaving it off the list of cryptocurrencies considered securities. This looks promising for the long run. Still, in the short term, we're keeping it bearish until further updates.

As always, thanks for reading 🙏

100% Success Money Back Guarantee

If our approach doesn’t outperform the overall crypto market during your subscription, we’ll give you a full refund of your membership. No questions asked. For quarterly and monthly subscribers this is applicable once your subscription runs for 6 consecutive months.

Take your next step towards crypto success

$799/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

What’s included in Pro:

Success Guarantee, if we don’t outperform the market, you get 100% back, no questions asked

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

Our latest memecoins pick with 50X potential

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the success guarantee work?

If our approach to the market doesn’t beat the overall crypto market during your subscription, we’ll give you a full refund of your membership fee. No questions asked. For quarterly and monthly subscribers this is applicable once your subscription runs for 6 consecutive months.