Gone are those days of settling for modest 5-6% returns; you can now double the yield.

Today, Ethereum validators are smiling to the banks, thanks to various additional benefits, including airdrops, restaking, smoothing pools, and miner extractable value (MEV), all contributing to substantially higher yields.

Is there an opportunity for you to get in on the action too?

Get ready for some juicy numbers!

TLDR 📃

- Ethereum validators leverage additional benefits to increase their staking yields.

- Diva launched the first airdrop exclusive to validators.

- Through EigenLayer, validators can simultaneously restake their staked ETH on multiple networks.

- Smoothing pools provide consistent block rewards for all participating validators.

- Ethereum users can tap into these benefits through decentralised staking services.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

4 bonus ways Ethereum validators are raking in yield 🤑

While Ethereum validators traditionally earn a respectable 5-6% on their staked ETH per year, there are now pathways to significantly higher returns. Let's explore four of these avenues in detail.

Airdrops 🪂

This week, Diva, a new staking protocol launched the first airdrop available exclusively to node operators. Almost 2,500 validators have claimed their airdrop.

The $DIVA airdrop sets an exciting precedence for similar airdrops in the future because its shows that validators are willing to, wait for this, claim airdrop tokens with the same address they stake through.

Recipients were able to claim roughly 12,000 tokens each. The $DIVA tokens are non-transferrable, but token-holders can vote to change that restriction.

So how much might this airdrop be worth?

Just back of the napkin maths, assuming only a $50m market cap for $DIVA split across 1 billion maximum tokens, each recipient will have gotten $600 through the airdrop.

It’s not a lot, but this is likely the beginning of many more airdrops.

Restaking ♻️

Restaking recently went live on Ethereum through EigenLayer. Now, Ethereum validators can use their staked ETH to validate other networks simultaneously.

Other L1s often have yields that exceed the 5-6% available on Ethereum. But again, assuming the worst possible case, one might expect to receive an additional 2.5-3% in yield through restaking.

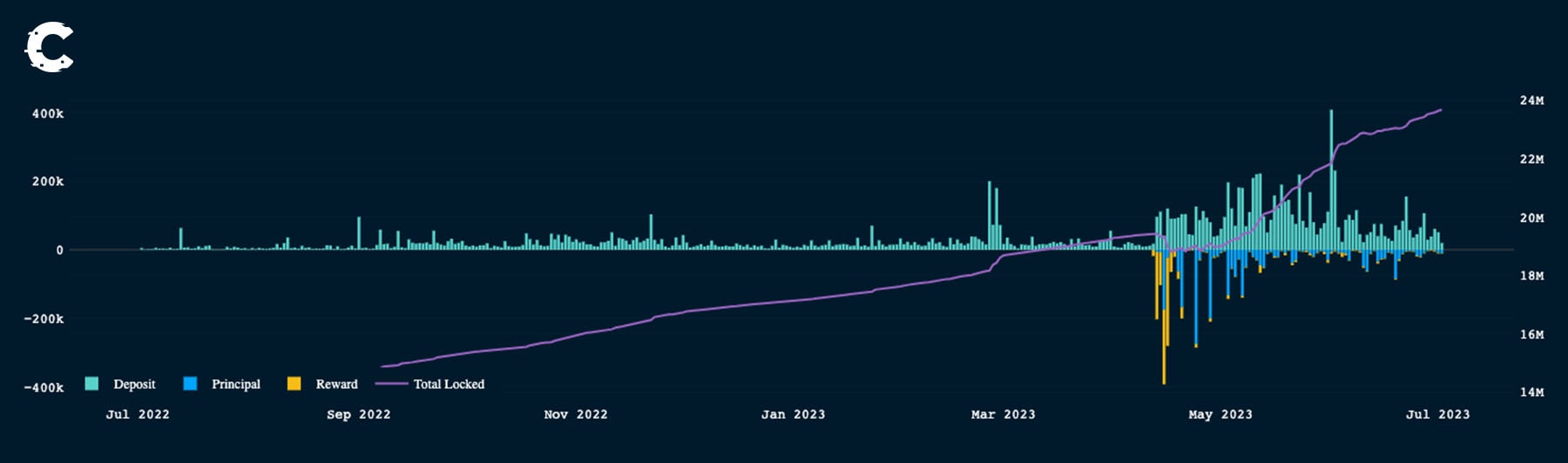

Unsurprisingly, validators quickly signed up, resulting in a rapid influx of deposits hitting the $16 million maximum limit.

Smoothing pools 🏊♂️

Now, let's talk about smoothing pools. These pools allow node operators to share the revenue generated from priority fees.

Typically, node operators wait for their turn to add blocks to the blockchain and earn block rewards. The problem is: who gets to add a block is entirely random, but smoothing pools fix that.

When participating in a smoothing pool, validators redirect any received priority fees to a shared pool. The funds in the pool are equally split between all validators that are part of it.

The smoothing pools can be incredibly rewarding, especially in periods of high gas usage. For instance, the Rocketpool smoothing pool has generated rewards of 35% on top of base validator rewards over the past year. It equates to an additional 2% APY, further adding to the yield potential for node operators.

MEV 👹

Finally, the elephant in the room: MEV.

MEV happens when validators order transactions (including some of their own) in a way that makes them profit.

MEV has become a significant source of income for node operators, with Flashbots emerging as the predominant MEV tool, processing over 95% of blocks today.

MEV currently accounts for 15% of the revenue generated by node operators, translating to an additional 1% APR for most validators.

Cheapest way to join Ethereum validators 👨💻

Ethereum validator airdrops, restaking, smoothing pools, and MEV are all great for validators. How can everyday ETH users like you benefit?

If you don't have the required 32 ETH to set up a node, don’t worry. You can still get a slice of juicy eth staking steak.

Well, this is where projects like Rocketpool and Diva come in. Let's delve into the offers a little bit:

- Rocketpool is the go-to decentralised staking service, enabling anyone to become a node operator by depositing 16 ETH or 8 ETH. By running a Rocketpool node, you can enjoy all the benefits available to validators. Node operators receive 15% of the yield generated from the crowdsourced ETH as a fee for operating the node. If you stake some RPL, you can receive an extra 5% minimum on the staked RPL.

- Diva is the new staking service that launched an airdrop for node operators. Although it is not as battle-tested as Rocketpool, it offers the ability to spin up a node with only 1 ETH of your capital.

State of stake 🗳️

Little change in the momentum of Ethereum staking, with the inflows bringing the total to 23.6 million units of ETH.

Price analysis 📊

This might surprise you, but ETH just closed its 7th green monthly candle. There have been many obstacles this year, yet the mighty Ethereum managed to pull through. That's bullish to us.

We're sitting under a major resistance level on the higher timeframes, and that's $2,000. We’ve spent the last four months battling with this level, and we question whether we can see more upside. Our take?

It will take time, but flipping $2,000 into support will open the doors to $2,500.

Cryptonary’s take 🧠

So, how much can an Ethereum validator earn in today's landscape?

We know the possibilities and resulting setups can vary.

However, considering the minimum possibility using all the opportunities above, operating a node provides an initial 5% yield, restaking can contribute an additional 2.5%, smoothing pools deliver a further 2%, and MEV adds another 1% on top.

In sum, the total yield potential reaches an impressive 10.5%!

And that's without factoring in the potential airdrops.

If you take this path to become an ETH validator, you’ll also be contributing to the decentralisation of Ethereum, an act that genuinely deserves the reward.

As always, thanks for reading! 🙏

Cryptonary, out!

100% Success Money Back Guarantee

If our approach doesn’t outperform the overall crypto market during your subscription, we’ll give you a full refund of your membership. No questions asked. For quarterly and monthly subscribers this is applicable once your subscription runs for 6 consecutive months.

Take your next step towards crypto success

$799/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

What’s included in Pro:

Success Guarantee, if we don’t outperform the market, you get 100% back, no questions asked

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

Our latest memecoins pick with 50X potential

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the success guarantee work?

If our approach to the market doesn’t beat the overall crypto market during your subscription, we’ll give you a full refund of your membership fee. No questions asked. For quarterly and monthly subscribers this is applicable once your subscription runs for 6 consecutive months.