So, what exactly are we? What's DeFi? Is it simply a digital version of penny stocks, a chaotic casino of new projects seeking to snatch up capital and attention? Or are we shaping the future of finance?

As a budding industry, we're a bit of both and we're still figuring out our place in this world. The parade of sh*tcoins isn't stopping anytime soon, but we can assure you, if you shrug off the substantial progress and devote all your attention to these memecoins, you'll end up like that poor sap pushing 65, buying lottery tickets daily with hopes that dwindle by the minute.

But, on the flip side, if you choose to focus on the developments, the fundamentals, and the seemingly "yawn-worthy" aspects of DeFi, you might just find yourself in the same league as those who invested early in Amazon. The trick? Stay informed with the latest market developments and follow the money. And guess what? We're here to help you do just that.

So, grab a comfy seat, kick back, and enjoy the read. 📖

TLDR 📃

- The market has largely flatlined, with no new capital coming in. Existing funds are being shifted towards sh*tcoins.

- Much of the recent activity is retail-led, driven by individuals gambling on memecoins.

- Despite increased DEX activity, the majority of users still turn to CEXs for their crypto dealings. DEXs only account for a minor portion of total crypto spot volume.

- Emerging ecosystems like Hedera are making impressive strides, with SaucerSwap, their equivalent of Uniswap, leading the way.

- Bridge flows in and out of Avalanche have surged, with Stargate Finance leading the charge, indicating a growing interest in the ecosystem's potential.

Disclaimer: Not financial nor investment advice. Any capital-related decision you make is your full responsibility.

The sh*tcoin show - courtesy of PEPE 🐸

PEPE mania is a prime example of the kind of activity we’d expect in a casino.

Launched four weeks ago, the PEPE memecoin hit a $1 billion valuation in about three weeks. Why? We can’t answer that – the crypto market is a strange place.

But as we’ve seen with DOGE, SHIB, CumRocket, and many others, the power of memes is strong.

Some holders have managed to turn $50-100 into multiple millions – just as some people leave Las Vegas and Monte Carlo with fortunes. Gambling.

We’ll make a bet of our own: More than a few PEPE degens will hold those tokens on a round trip back to zero.

As you can see, the chart is already looking gruesome.

We could be wrong. They could turn their seven-digit gains into eight digits.

But they probably won’t.

Betting on memecoins is harmless unless life savings are involved. Just remember, that’s all it is: gambling.

Let's face it, you won't turn your $25 into $1M anytime soon, but you sure as hell can turn it into a significant 5-10-20x if you know where to bet in DeFi. Today we're going to show you exactly where the action is.

Is Ethereum the place to fish for projects? 💭

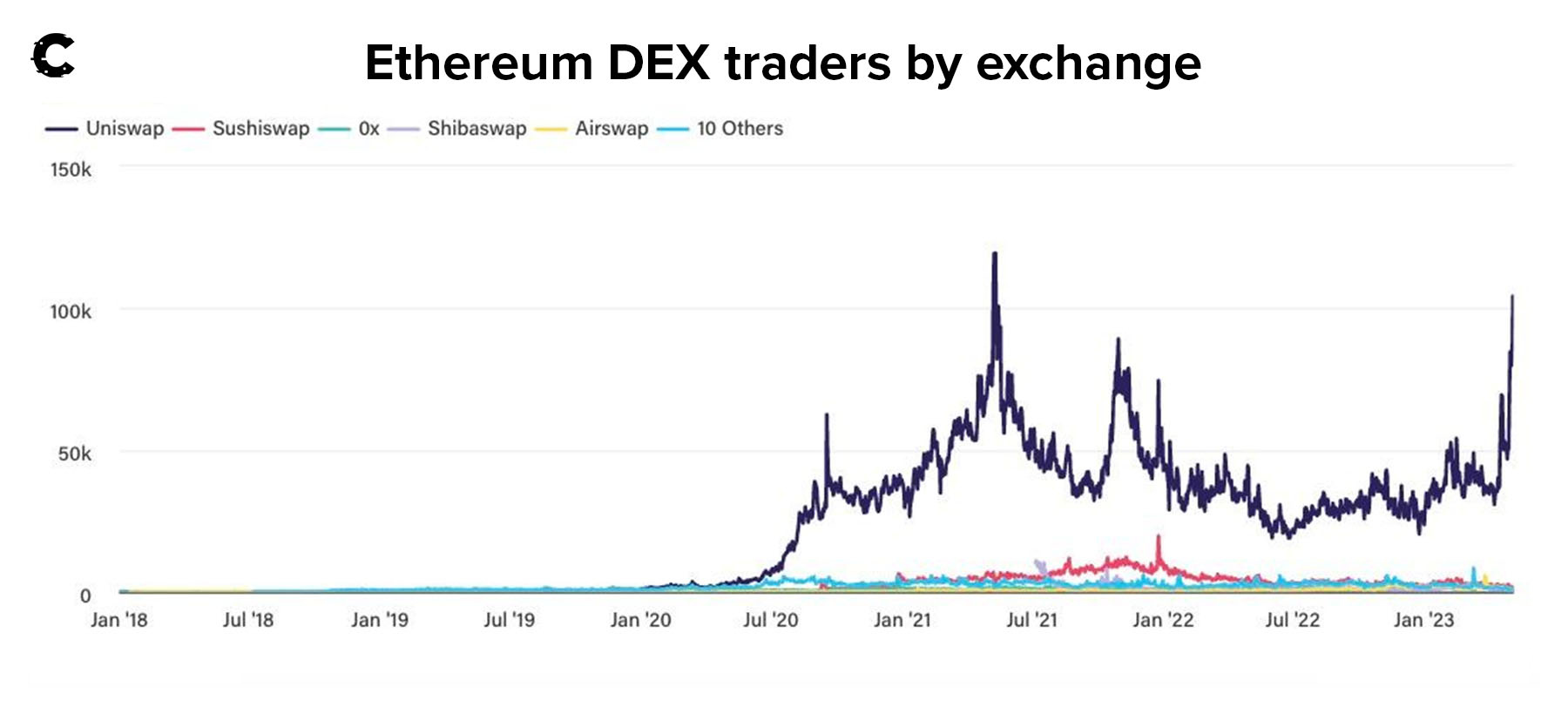

Ethereum reached a number of DEX traders levels not seen since the peak of the 2021 bull market.

Does this mean that the fundamentals of Ethereum DeFi just took a leap forward? Let's dig into who these fresh-faced traders are. After all, if this influx of cash is snapping up shares in legitimate projects, then hey, we've got attention. Time to do some detective work.

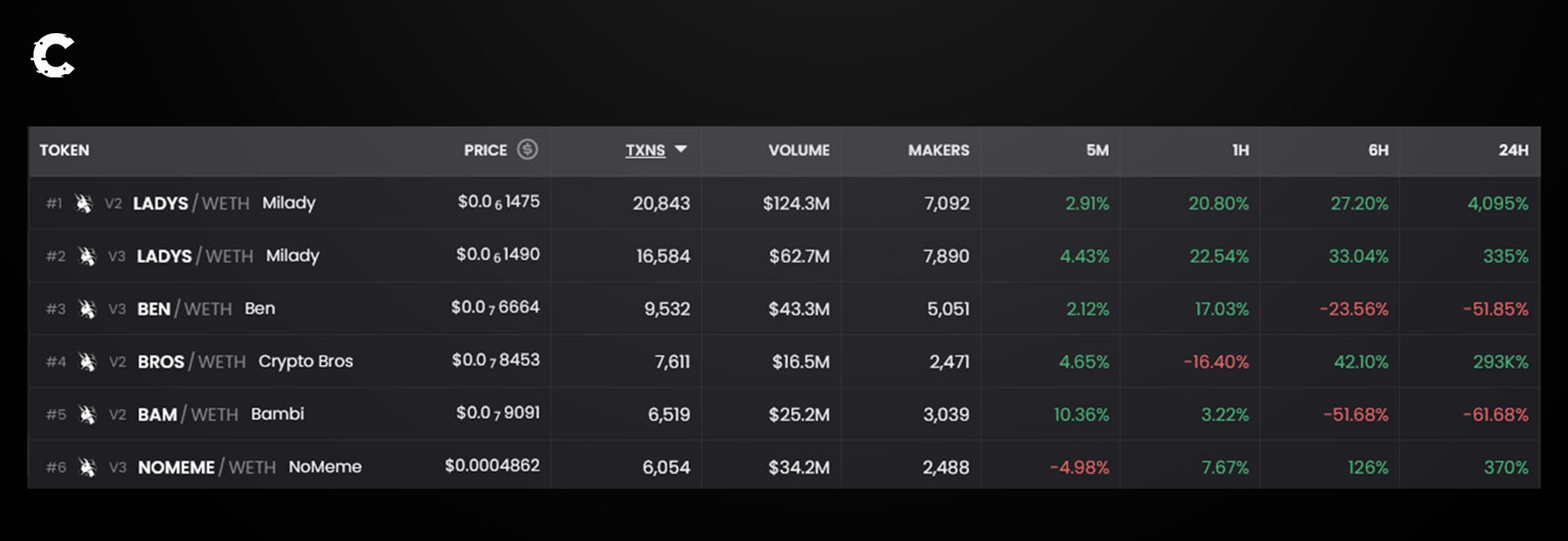

Peering under the hood, what's this new money up to? They're dealing in sh*tcoins on decentralised exchanges, or DEXs. The casino doors are wide open, folks.

No one can dispute the surge of innovation happening on Ethereum. Its DeFi ecosystem is positively humming. But here's the rub: the rise of these sh*tcoins could spell trouble for the ecosystem as more naive investors come in, get disillusioned, dump their holdings, and set off a negative ripple effect down the line. So, brace yourself for some turbulence. And this storm isn't confined to one ecosystem—it's likely to spread.

In the meantime, your mission, should you choose to accept it, is to discover the real deal - the top builders and the ecosystems that are quietly creating something special, far from the limelight.

One unexpected ecosystem is rising 🏢

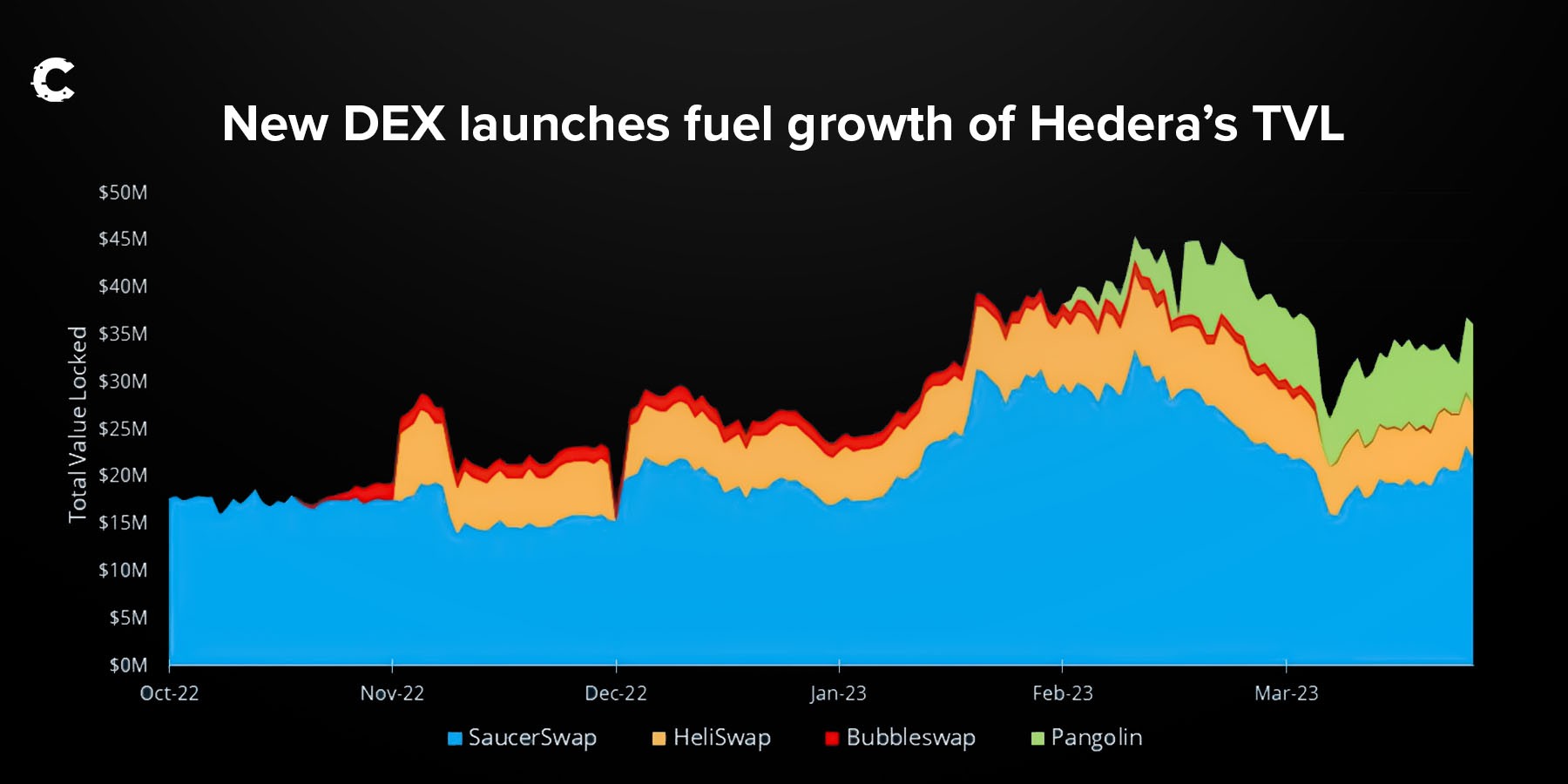

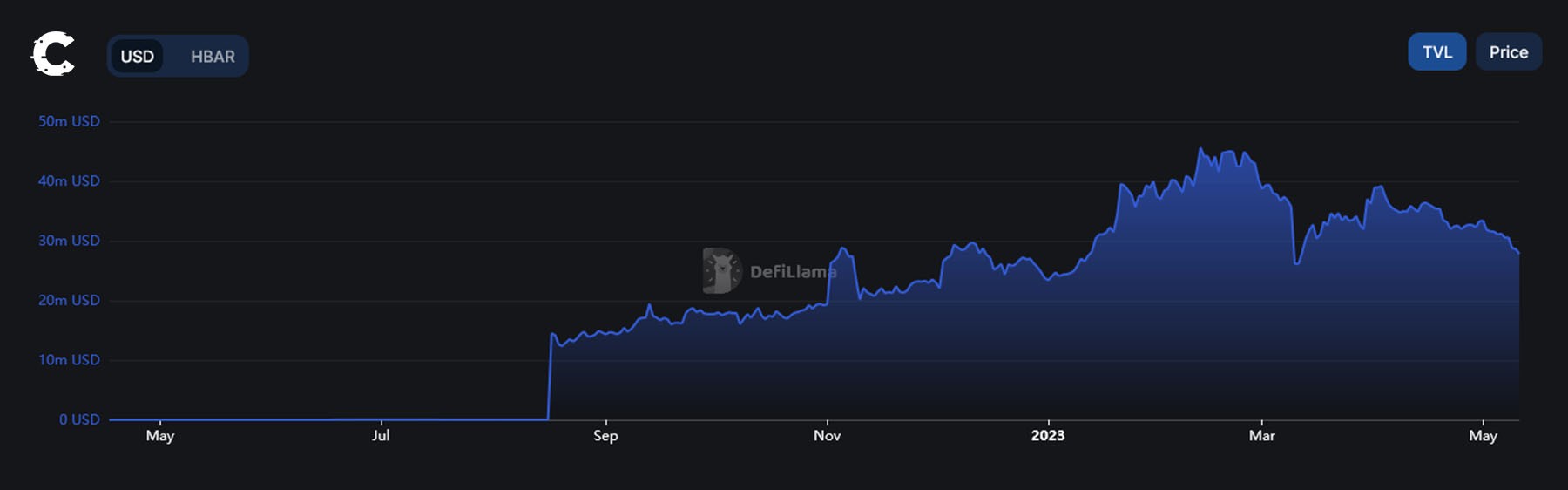

DEXs, or decentralised exchanges, are the lifeblood of DeFi, circulating liquidity and creating value by allowing us to swap our assets with ease. That's why DEXs are usually the first to set up shop in a new ecosystem.One unexpected contender entering the ring is Hedera.

Hedera is a fascinating ecosystem - a real standout. Few Total Value Locked (TVL) charts resemble what we're seeing here:

Hedera DeFi is a relative newcomer, with several DEXs setting up in the last six to eight months. The surge in TVL is noteworthy, especially since DeFi's overall TVL has been on a downhill slope since November 2022. If this upward trend sticks, Hedera could offer us a compelling spectacle, with SaucerSwap - Hedera's answer to Uniswap - being the star of the show.

Avalanche: the "odd" attention grabber 🤑

Despite the buzz around Layer-2s, Avalanche has managed to carve out its own upward trajectory. We flagged this in a previous post, and since then, activity hasn't just maintained - it's grown.

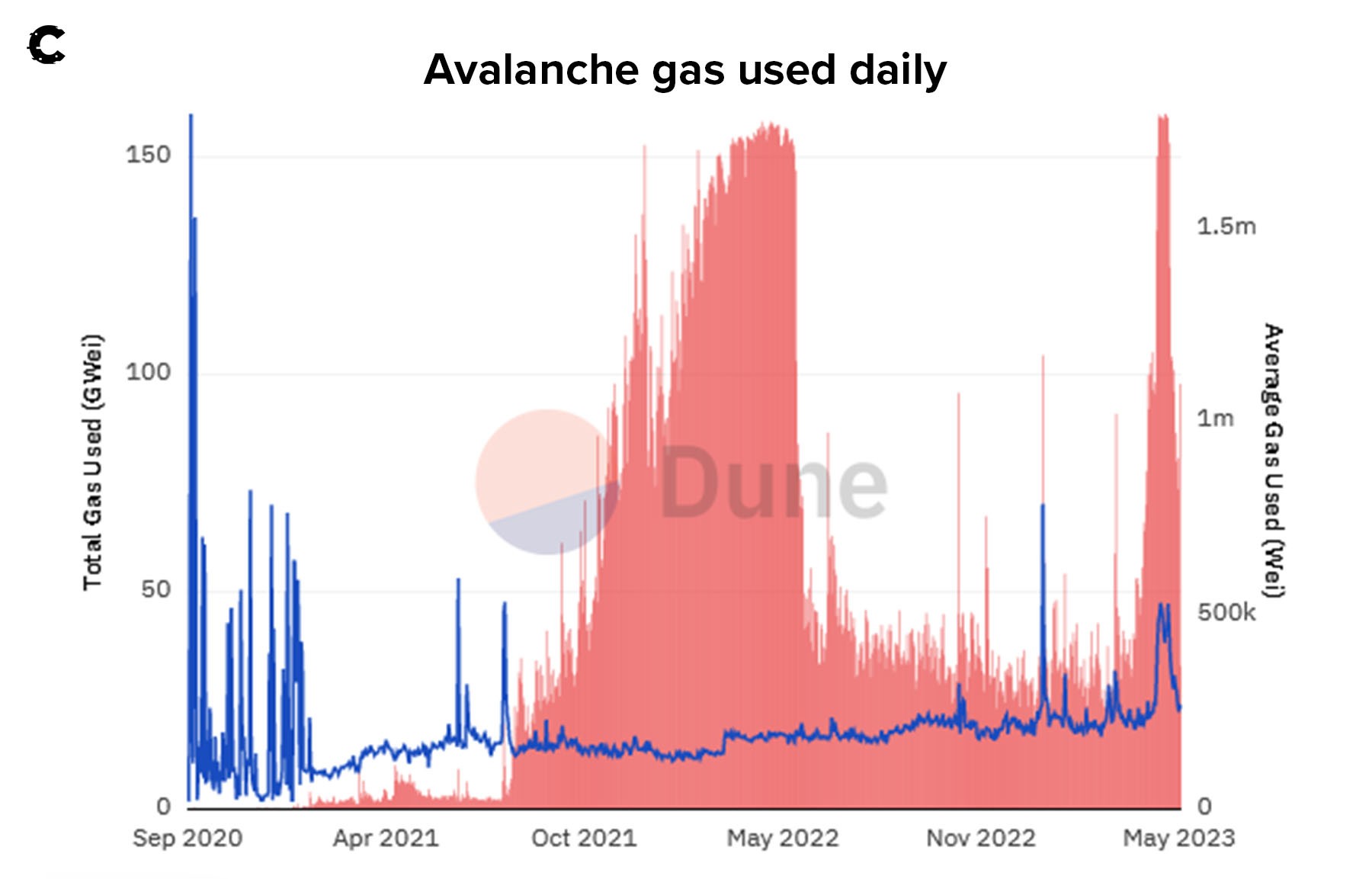

An increase in Ethereum and Bitcoin transactions has led to a ripple effect in the Avalanche ecosystem, with longer waiting times and heftier transaction costs. Oddly enough, while the fee spike was expected due to the sh*tcoin shenanigans on Bitcoin and Ethereum, Avalanche wasn't an obvious contender.

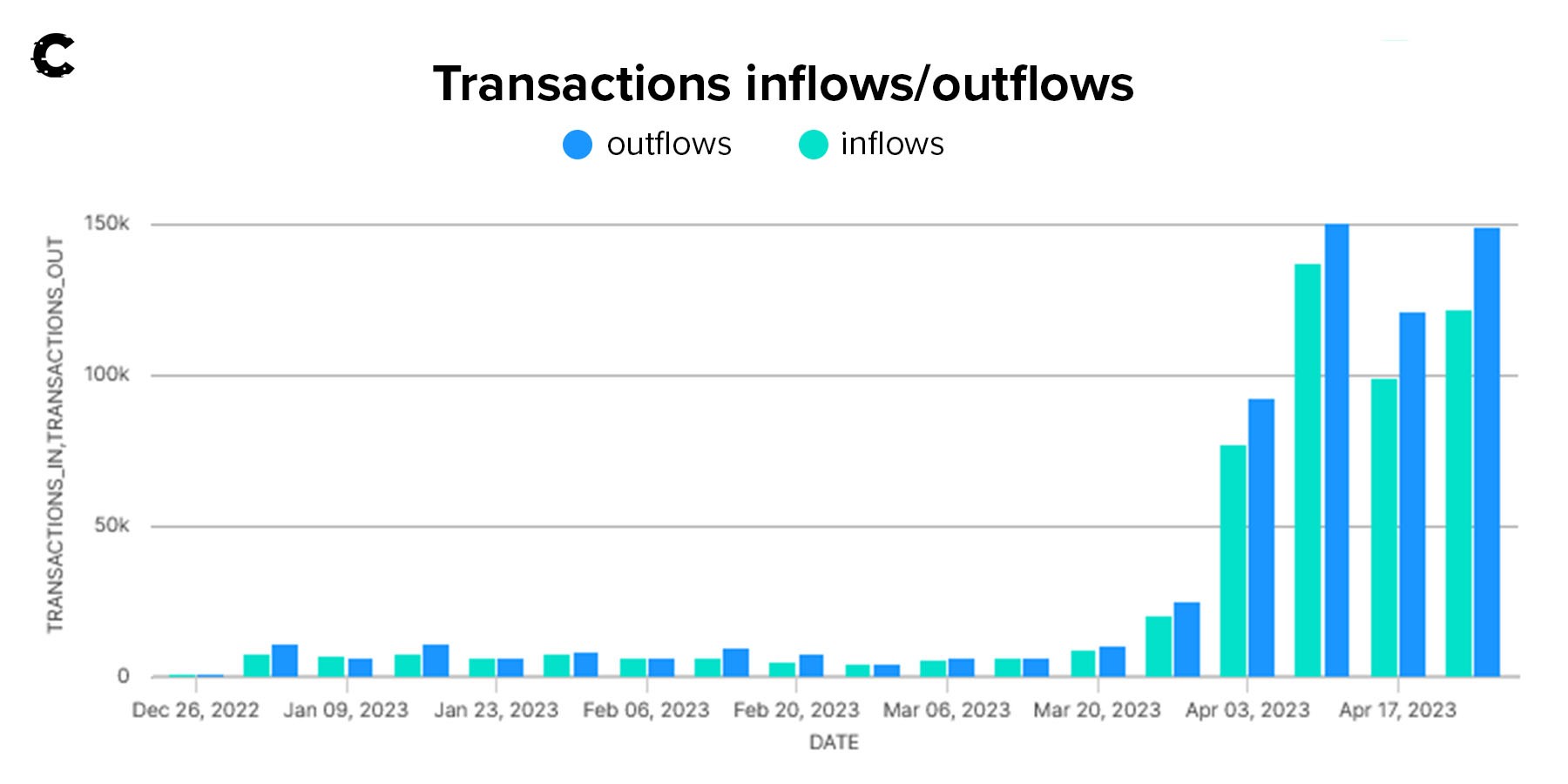

Bridge flows in and out of Avalanche have shot through the roof, with Stargate Finance (a bridge by the LayerZero cross-comms team) taking the lead.

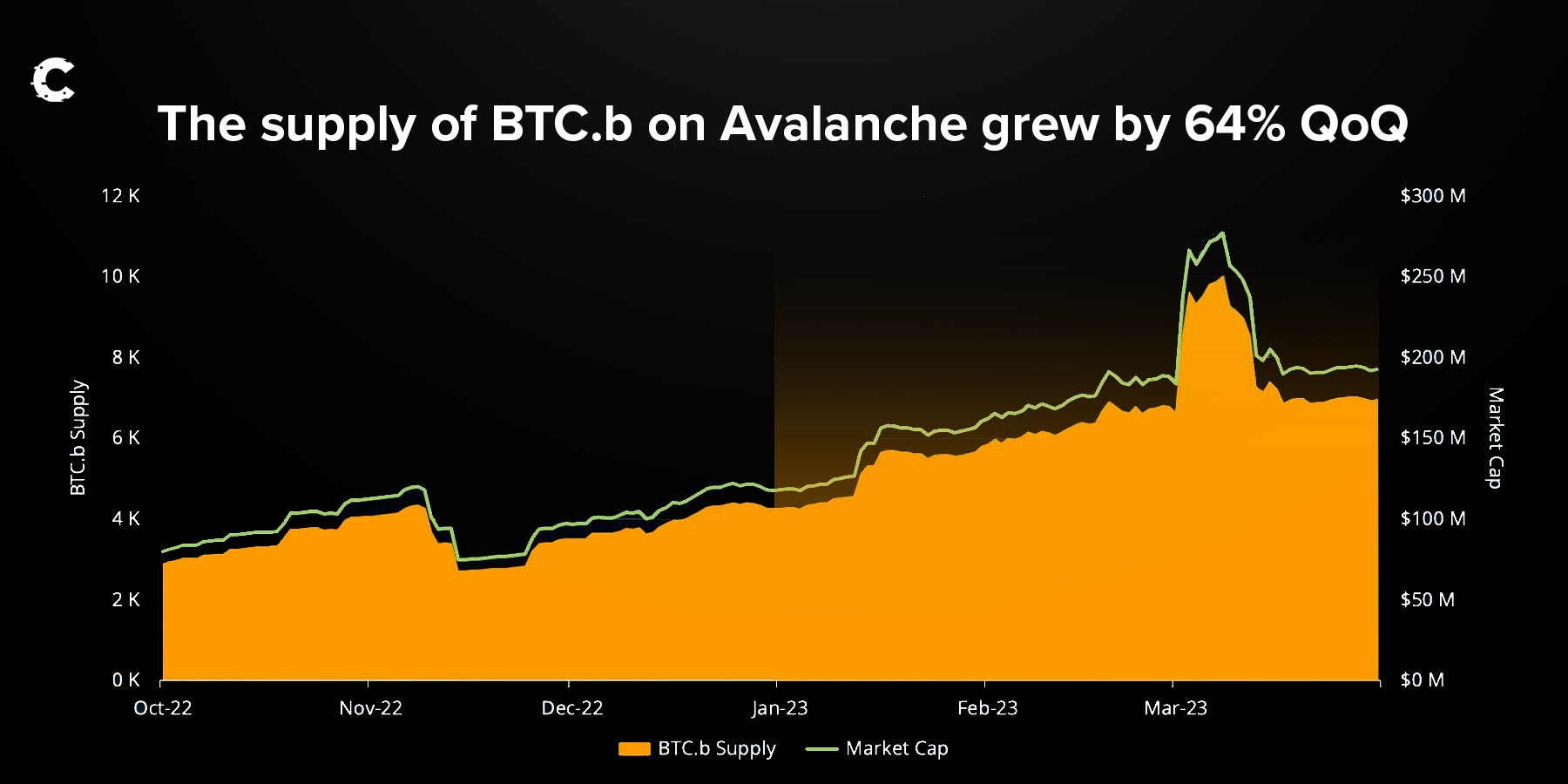

BTC.b adoption on Avalanche gained momentum rapidly after LayerZero's endorsement in Q4 2022. The supply of BTC.b on Avalanche swelled by 64% in Q1, hitting a market cap north of $250 million.

Here's why BTC liquidity matters: it's the single largest liquidity pool in crypto. And Bitcoin's involvement in DeFi is on the rise - in fact, it's a clever strategy many ecosystems are deploying to reel in capital (Solana's about to hop on that bandwagon).

And here's a shocker - even the Bitcoin ecosystem is seeing token activity, a sentence we never thought we'd write. We recently delved into memecoins on Bitcoin in our latest network digest, which you can find here.

Does this mean DeFi Summer 2.0 is here? 🤔

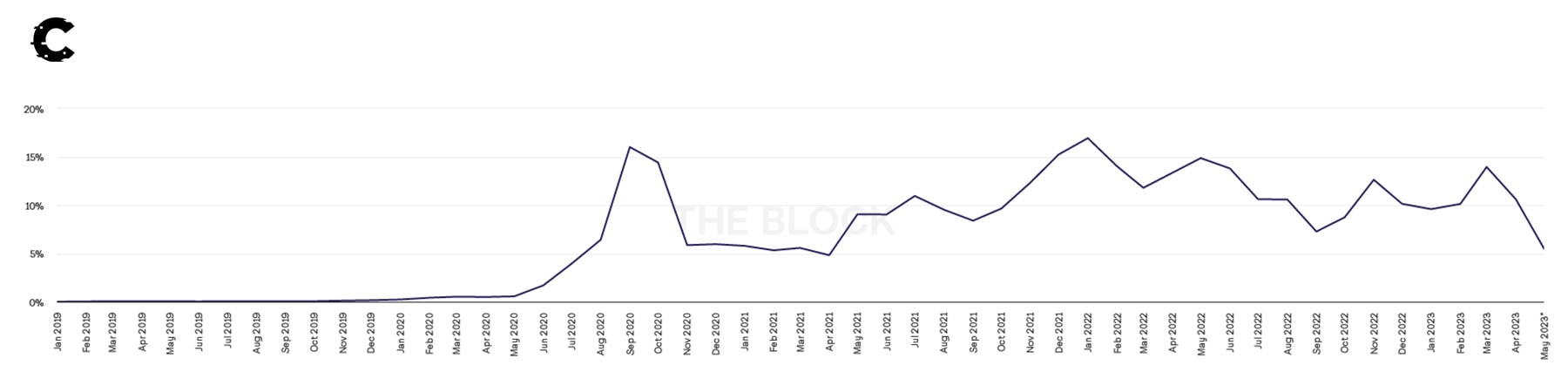

Not so fast. Despite a surge in DEX activity across various ecosystems, the majority of users still gravitate towards centralised exchanges, or CEXs, to scratch their high-risk gambling itch. DEXs make up a mere 6% of total crypto spot volume, a figure that's actually dipping. A handy tip for gauging the success, buzz, and attention around any DeFi ecosystem? Keep an eye on the base layer's token (ETH, SOL, AVAX, HBAR...).[caption id="attachment_272827" align="aligncenter" width="1800"] DEX to CEX spot trade volume (%).[/caption]

DEX to CEX spot trade volume (%).[/caption]

The reality? Apart from BTC and ETH, very few assets have yielded substantial returns since the dawn of 2023. Exclude BTC and ETH, and the crypto market cap has pretty much flatlined. This suggests that no fresh capital is entering the market. Rather, traders are repurposing funds already on-chain to take a punt on these tokens. Essentially, we're witnessing a reallocation to sh*tcoins - or, to put it bluntly, gambling.

Cryptonary’s take 🧠

The across-the-board uptick in activity is retail-led, mostly by individuals gambling on memecoins.How do we know this? Because significant capital has yet to return to the market – as shown by the lack of positive price action across the crypto market and big caps. On-chain activity is not driven by fundamentals for the most part. Sh*tcoin gains are not a long-term positive factor. Many of the memecoins that pumped are already beginning to retrace.

We think increased DeFi participation is a good thing. But increased volume from memecoin pumping has historically preceded the end of bullish momentum.

On the bright side, the retrace in the market represents an opportunity to pick up outperformers.

Increases in DEX participation are encouraging evidence that DeFi is far from dead. The market’s not all bad if Hedera TVL, led by DEXs, can show strong, consistent growth despite generally negative market conditions.

100% Success Money Back Guarantee

If our approach doesn’t outperform the overall crypto market during your subscription, we’ll give you a full refund of your membership. No questions asked. For quarterly and monthly subscribers this is applicable once your subscription runs for 6 consecutive months.

Take your next step towards crypto success

$799/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

What’s included in Pro:

Success Guarantee, if we don’t outperform the market, you get 100% back, no questions asked

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

Our latest memecoins pick with 50X potential

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the success guarantee work?

If our approach to the market doesn’t beat the overall crypto market during your subscription, we’ll give you a full refund of your membership fee. No questions asked. For quarterly and monthly subscribers this is applicable once your subscription runs for 6 consecutive months.