In a series of twists and turns, Bitcoin buckled and bounced back as soon as the market realised that the news was only a temporary setback.

Yet, amidst this turmoil, one company is uniquely positioned to ride the Bitcoin bull to the moon!🚀

Let's delve deeper into the details.

TLDR 📃

- SEC's new requirement for ETF applicants leads to a temporary setback for Bitcoin.

- Bitcoin miners deposit large amounts of BTC onto exchanges.

- Bitcoin enters "Greed" territory on the Fear & Greed Index.

- Court order directs Celsius to convert altcoins into BTC and ETH, boosting Bitcoin dominance.

- Coinbase stock skyrockets by 138% due to new role as surveillance partner for ETF applicants.

- Overall, Bitcoin maintains strength, and Coinbase rises despite new SEC challenges.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

SEC rejects TradFi’s ETF applications 🤔

This week started gloomy for Bitcoin, with news headlines filled with reports that the SEC has primarily rejected TradFi applications to launch Bitcoin spot ETFs – as expected, this was a problematic update.

Last month, we discussed Bitcoin’s TradFi takeover, so news that applications for Bitcoin sport ETFs were rejected sounded like bad news.

But in truth, there’s nothing worth worrying over.

We dug deeper into the news reports to discover that the SEC asked applicants to resubmit their filings, this time specifying a surveillance-sharing partner.

Surveillance-sharing agreements involve the sharing of trading data between companies to detect and prevent market manipulation. All companies filing for ETFs were asked to list who their surveillance partner would be, and they’ve mostly all just done that, including Blackrock.

Now, here’s where it gets interesting! They’ve all listed the same company: Coinbase.

More to come on this in a bit.

BTC euphoria takes a pause 🚦

While the SEC “rejections” are no cause for concern, they did cause a big enough stir to slow down the bullish momentum. Miners might be the paper hands this time around.

Miners send heaps of BTC to exchanges 🌊

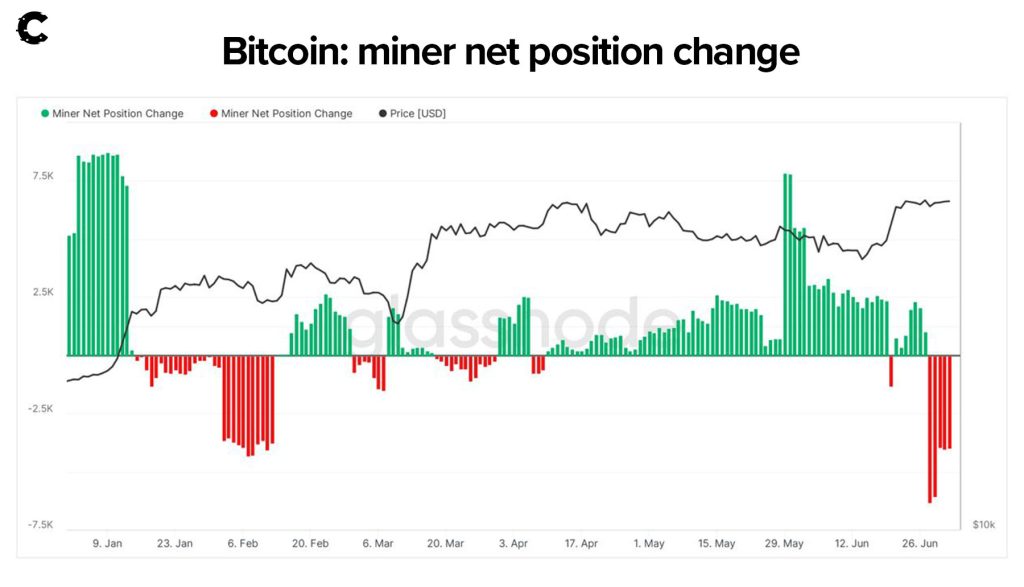

Miners have been depositing loads of BTC onto exchanges, indicating they intend to sell. In the past week alone, miners have sent $128 million worth of BTC to exchanges.

The chart below illustrates the flow of BTC into and out of miners' wallets. Green lines indicate the amount of BTC entering miners' wallets, while red lines represent BTC leaving.

However, there’s also a chance that this influx of supply is regular end-of-quarter activity. It coincides with the end of Q2, so the mining companies could sell some BTC to optimise their balance sheets for investor reports.

Metrics indicate BTC is becoming overbought 📝

Another aspect causing concern has been the euphoria itself.

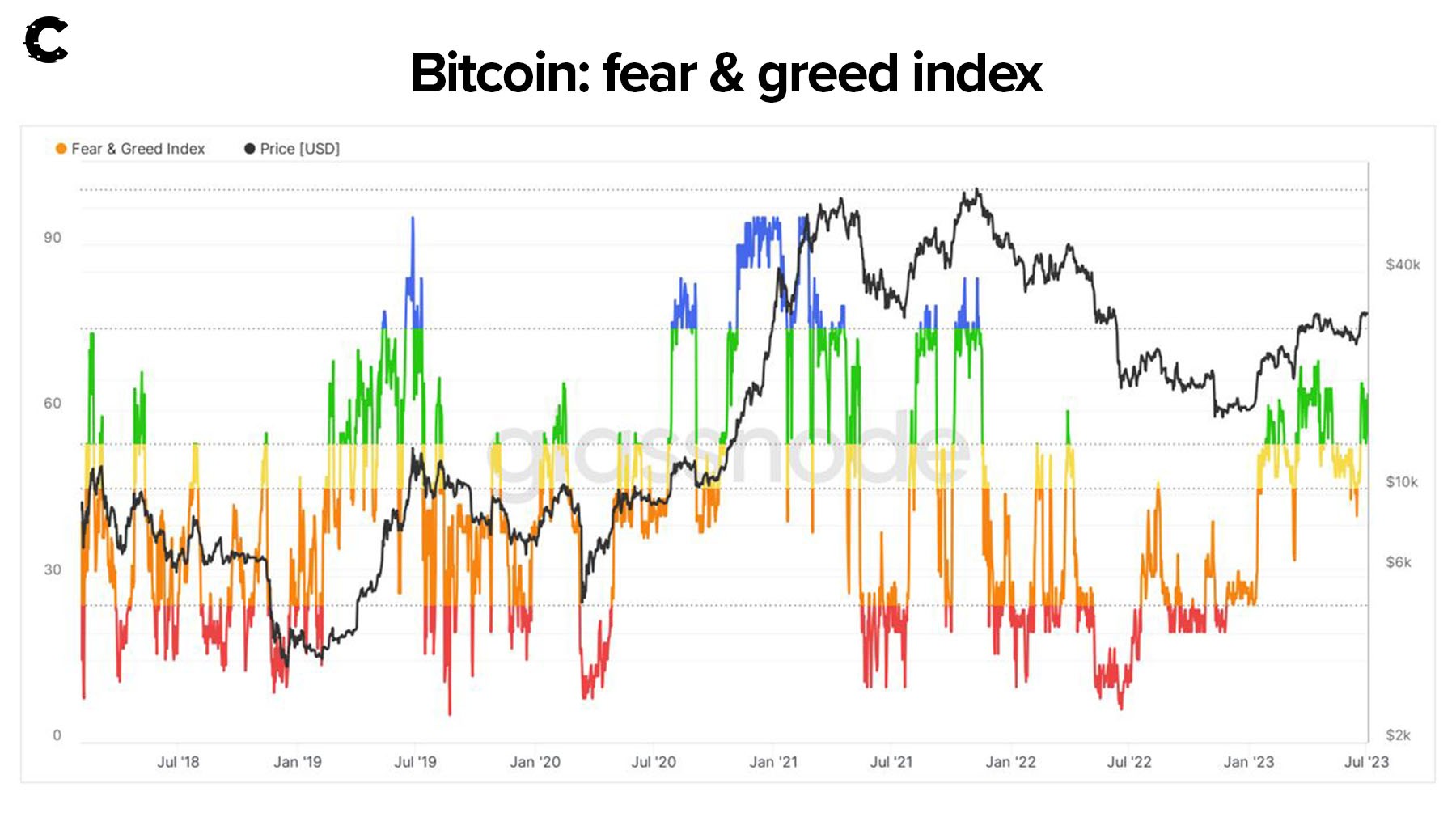

Yes, sentiments from the last few weeks of the Bitcoin rally have pushed BTC into Greed territory on the Fear & Greed Index.

This index measures investors' feelings about Bitcoin: fear corresponds to bearish sentiment, and greed reflects bullishness. Significant swings in either direction on the index often indicate a potential reversal in the trend.

But the BTC party isn’t over yet 🎉

Yes, the fear and greed index provides some insight. However, if you think the BTC party is over, you are wrong!

Let’s unpack why you can’t afford to give up on Bitcoin now.

Celsius ordered to convert assets into BTC & ETH 💰

It starts with a court order.

A court order has mandated Celsius to liquidate all their altcoin holdings and convert them into BTC and ETH. That buying pressure is bullish for Bitcoin and will drive its dominance even higher.

Buying pressure from Celsius alone could absorb the $128 million worth of BTC that miners have been preparing to sell.

Bitcoin dominance remains high 🦾

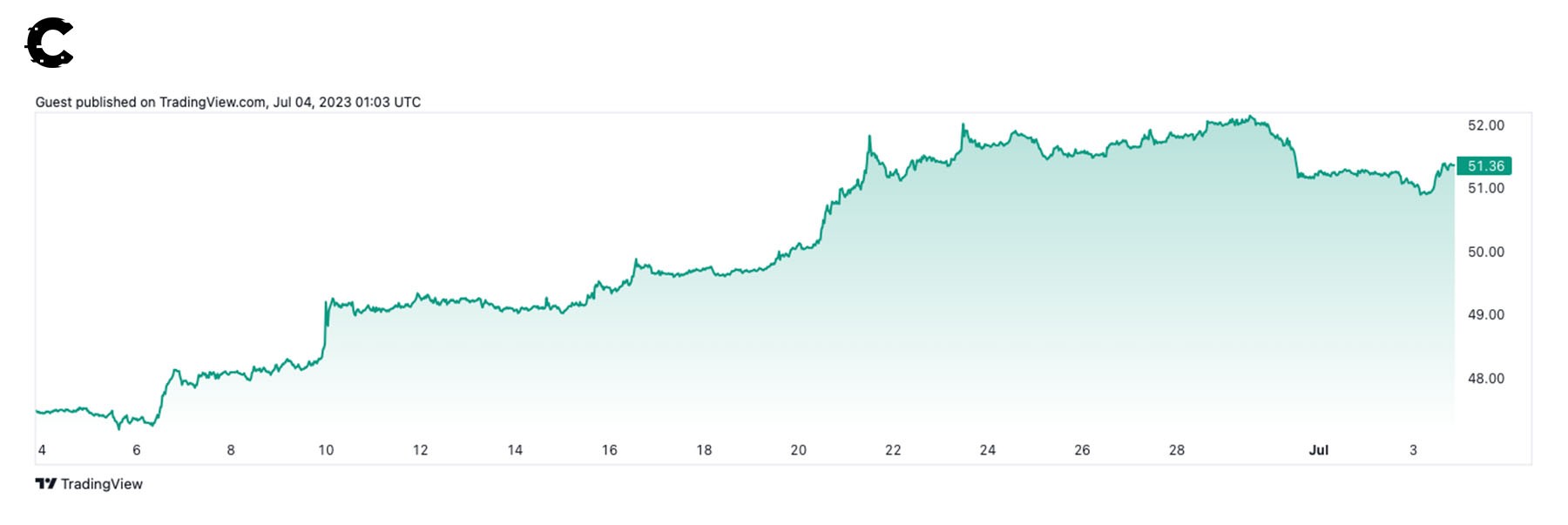

Although BTC's dominance took a temporary pause, its momentum still appears strong.

BTC's value still accounts for over 51% of the crypto market. The SEC's initial setback proved to be short-lived, leaving BTC hodlers relatively unfazed.

Coinbase emerges as the biggest winner in BTC 🚀

And now, to the big winner!

Coinbase stock is up 138% this year 📈

Although BTC took a brief break on its rally, Coinbase’s stock is shooting for the stars! Up almost 12% in a single day yesterday and 138% for the year, Coinbase has even exceeded BTC’s growth this year - by over 50%!

The surge is mainly due to Coinbase being listed as the surveillance partner for Blackrock, Fidelity, and all the other ETF applicants. You remember that surveillance partner stuff we discussed above, right?

Now, Coinbase stands to generate significant revenue from these agreements while offering the exchanges a lot of legitimacy with regulators.

In addition, Coinbase is set to custody the funds for Blackrock’s ETF, giving it a combo win of BTC exposure and revenue.

Bullish on BTC means bullish on $COIN 🔥

Bitcoin is digital gold, and Coinbase makes the tools to access it.

Coinbase makes the equipment for the gold rush, and that can sometimes be more profitable than the gold itself.

Most of the TradFi companies making Bitcoin bets are doing it through Coinbase, and this vantage position in the BTC industry is reflected in its valuation.

With another gold rush on the horizon, it may be worthwhile to have exposure to those making the tools as well.

There is a risk, of course: the stock has shot up so much that the current situation may be a “buy the rumour, sell the news” event. Always assess your risks carefully!

Price analysis 📊

Bitcoin is indeed at resistance. That might make it difficult for its price to break through $32,000, but we're confident it can and for a good reason. You can check more on that here. (link to the monthly TA)

There has been a significant change in Bitcoin's weekly timeframe - creating a higher high. This is the first sign of a potential shift in market structures from bearish to bullish. The technicals are looking good, but an unstable macro environment and even a crypto environment like the one we had back in Q2 can bring Bitcoin's price down. You need to consider that before changing your bias.

For now, our eyes are on $32,000. We need this level to be flipped into support before confirming more upside.

Cryptonary’s take 🧠

The SEC turned the Bitcoin rally into an obstacle course, but the gloom and doom reports are greatly exaggerated.

While worries captured the crypto community this week, there’s plenty more to be excited about rather than anxious about.

BTC has remained strong, and Coinbase has soared! As either of them succeeds, the other also gains plenty.

As always, thanks for reading! 🙏

Cryptonary, out!

100% Success Money Back Guarantee

If our approach doesn’t outperform the overall crypto market during your subscription, we’ll give you a full refund of your membership. No questions asked. For quarterly and monthly subscribers this is applicable once your subscription runs for 6 consecutive months.

Take your next step towards crypto success

$799/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

What’s included in Pro:

Success Guarantee, if we don’t outperform the market, you get 100% back, no questions asked

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

Our latest memecoins pick with 50X potential

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the success guarantee work?

If our approach to the market doesn’t beat the overall crypto market during your subscription, we’ll give you a full refund of your membership fee. No questions asked. For quarterly and monthly subscribers this is applicable once your subscription runs for 6 consecutive months.