$10,000,000,000 LIQUIDATEDThe data varies from one data aggregator to another but the number agreed upon ranges between $6.5B and $10B. For reference, the Black Swan of 2020 liquidated just over $1B in long positions even though the market dipped more than twice as much as it did today.

On average, crypto-asset prices dropped by an average of -18% with some of them crashing by over -99% of their value on some exchanges. For example, REN (RenProtocol), which was trading near the $1 mark, dropped all the way down to just shy of $0.01 on Binance.

The Cause

People are attributing the crash to different events, the two most popular ones are:- Blackout in XinJiang which caused a -40% drop in the Bitcoin network hashrate

- Unconfirmed news about the U.S. Treasury charging several financial institutions with money laundering through crypto

The news, which we stress again as unconfirmed, may have triggered the selling and could be held accountable for a drop of up to -5% in prices. What accentuated the downside move is leveraged longs held on futures exchanges and their liquidations.

Liquidations

Leverage is a double-edged sword and should not be used by untrained traders. With that being said, leverage is plentiful and easily accessible in crypto which always leads to many new market participants falling into the common trap of over-leveraging.Example A long position taken with 50X leverage gets liquidated at just under a -2% movement in price (2% X 50 = 100% of collateral). The reason they get liquidated at under -2% is because the exchange needs to protect itself and ensure the position does not get closed at anything more than -2% and order slippage can cause that to happen which leads to an exchange having to cover losses. For that reason, they liquidate a position earlier than it should be in theory as a form of protection.

When a long position needs to be liquidated (closed) it means the long should be sold on the market. This causes excess selling pressure, first the 125X longs get liquidated which pushes the market lower and liquidated the 100Xers, then 50X and today even some positions at 5X were liquidated. This phenomenon is called cascading liquidations and this is what caused the market to drop this hard.

This brings us to an important point: every exchange have their own model for a liquidation engine. We will not delve into the details but we'll showcase how certain exchanges have traders' best interest in mind while others don't, we'll illustrate with a couple examples.

Binance: Owned 30% of Futures Open Interest ($13B out of $44B) but 60% of total liquidations ($4B out of $6.65B).

FTX: Owned 16.5% of the Futures' Open Interest ($7.25B out of $44B) but only 2.7% of total liquidations ($180M out of $6.65B).

By comparing the results, we can clearly see that Binance's liquidation engine is quite harsh and over-protective of Binance whereas FTX has one of the leading liquidation engines that is protective of customer funds.

Top Analysis: is this the top?

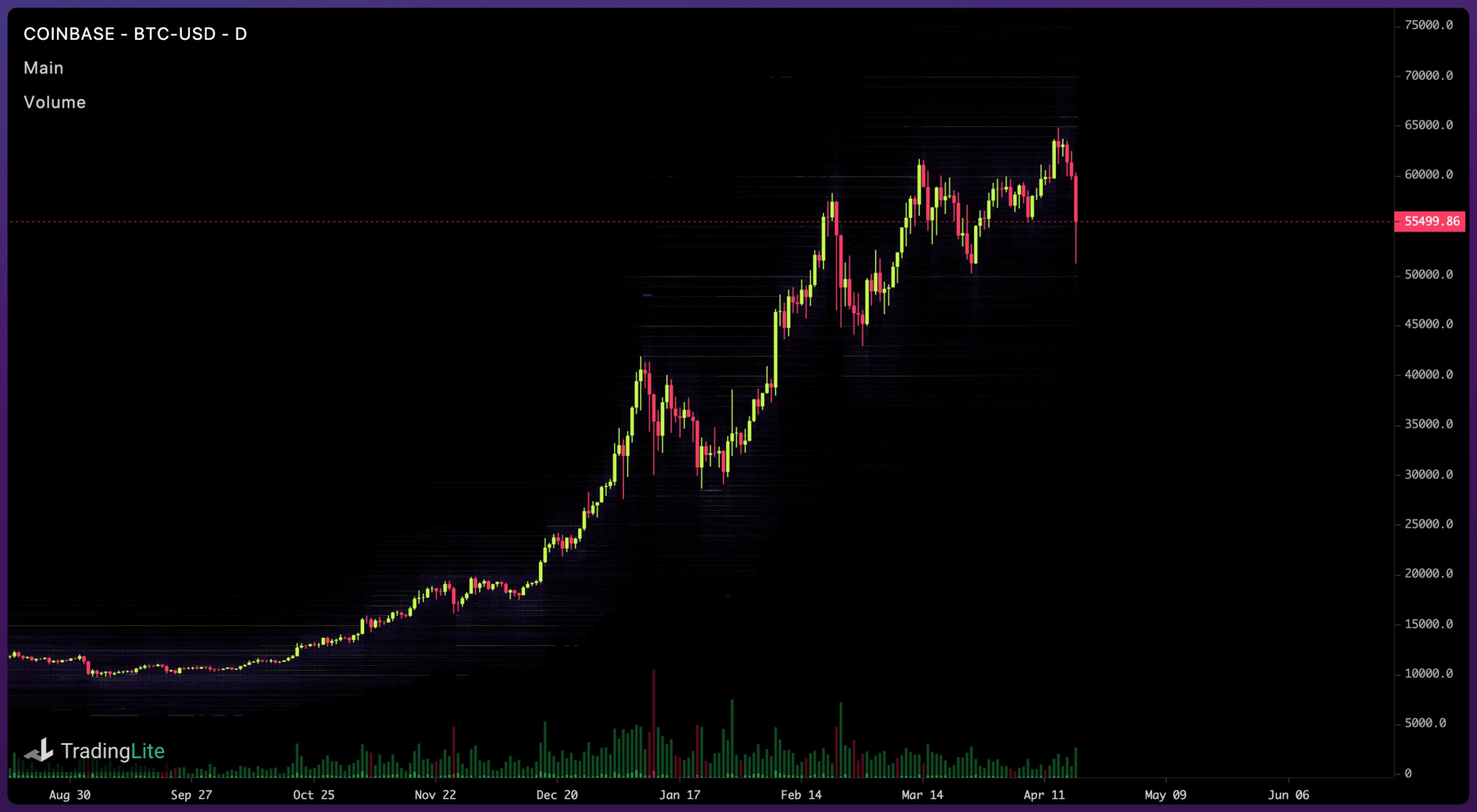

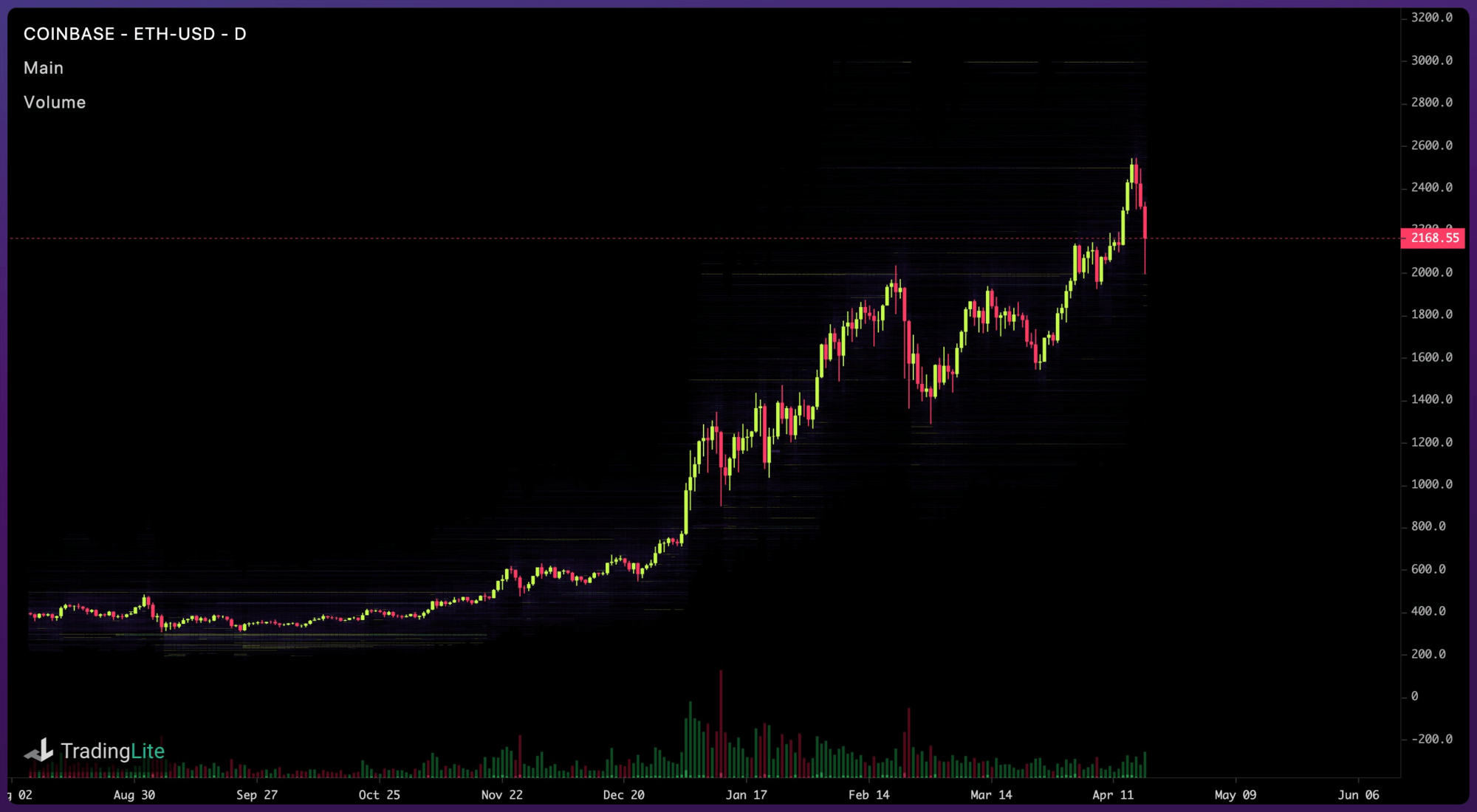

According to Dow Theory, volume must confirm the trend. Which means in order for a trend change to take place, we must see a change from high volumes during upside moves to high volumes during downside moves - or very simply: high volume selling. We'll take a look at both BTC & ETH spot markets to make a judgement.

In both cases, we can see the volumes on the spot market were not out of the ordinary by any means. This movement was led by the futures market because of the liquidations that took place. Based on the data we've been looking at throughout the day, we've come to the conclusion that odds are the top is still not in.

However, new retail participants may panic further in the coming days which can lead to some more downside wicks, especially on altcoins.

Get winning crypto tips in 5 minutes a day

Login or upgrade to Cryptonary Pro

Pro

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

$799

For your security, all orders are processed on a secured server.

What’s included?

24/7 Access to Cryptonary's Research team who have over 50 years of combined experience

All of our top token picks for 2025

Our latest memecoins pick with 50X potential

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily Market Updates that cover the real data that shape the market (Macro, Mechanics, On-chain)

Curated list of the most lucrative upcoming Airdrops (Free Money)

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.